Oct 18, 2019

As Investors Bail From Drug Stocks, Companies Step Up as Buyers

, Bloomberg News

(Bloomberg) -- Are you one of the of the many investors exiting drug and hospital stocks lately? Be advised: you may be selling your stock to the company that issued it.

That’s because health-care shares, whose returns trail every S&P 500 sector but energy this year, are being snapped up in repurchases.

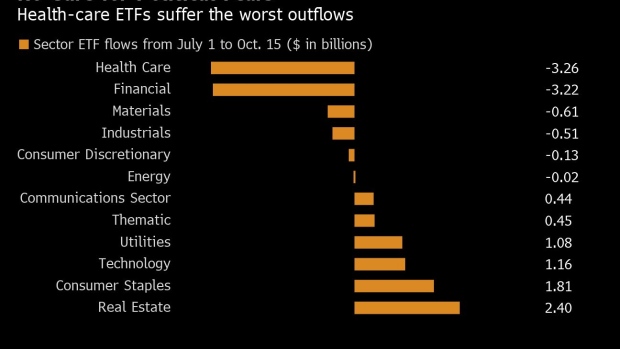

For a second week, Bank of America’s corporate clients spent near-record cash on buybacks. The spree is happening as investors have pulled more than $3 billion since June from exchange-traded funds focusing on health-care. The outflows are the biggest among sector ETFs tracked by Bloomberg.

The split reflects a tug-of-war between fundamentals and politics. Shares from Pfizer to UnitedHealth Group have fallen as politicians advanced drug-pricing regulations and promoted “Medicare-for-All” insurance plans.

Corporate repurchases are surging amid the lowest valuations in more than two years. Trading at less than 16 times forecast earnings, health-care shares are priced at a 14% discount to the market, data compiled by Bloomberg showed.

“This is smart, given some depressed levels,” Jared Holz, a health-care strategist at Jefferies, said of the buybacks. “It feels like a lot of negatives are well or at least better understood and appreciated.”

The surge in buybacks may be a vote of confidence from management on their own businesses. After all, the industry is one of the few in the S&P 500 whose growth has stayed positive amid trade and geopolitical turmoil, and is expected to remain so through at least next year, analyst estimates showed.

Health-care profits are estimated to increase 3.3% in the third quarter, compared with an expected decline of 3.6% for all companies in the S&P 500. Eli Lilly & Co., Anthem Inc. and Biogen Inc. are scheduled to report results next week.

To Francois Trahan, UBS Group AG’s head of U.S. equity strategy, the discount valuation suggests that part of the policy risk is already reflected in the stock prices. Investors spooked by those issues shouldn’t forget that the industry’s forecast earnings growth hasn’t been negative for more than 25 years, a track record that’s sure to boost its haven status as the economy heads for a slowdown, he said.

“Investors have been treating health care like a cyclical sector in the face of a slowing economy,” Trahan wrote in a note on Oct. 16. “We expect health care’s defensive characteristics to outweigh policy risk in the coming quarters.”

To contact the reporters on this story: Lu Wang in New York at lwang8@bloomberg.net;Tatiana Darie in New York at tdarie1@bloomberg.net

To contact the editors responsible for this story: Brad Olesen at bolesen3@bloomberg.net, Chris Nagi, Richard Richtmyer

©2019 Bloomberg L.P.