Jul 23, 2021

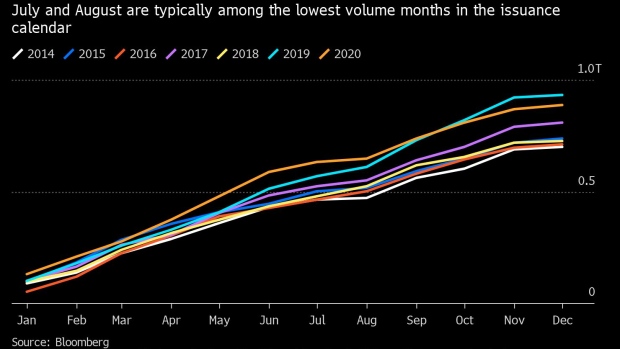

As Junk Bond Sales Near Record, Dealmakers Crave a Summer Break

, Bloomberg News

(Bloomberg) -- The customary summer slowdown couldn’t come sooner for the participants in Europe’s debt market after an intense 18 months of deals and travel bans kept them tied to their desks.

Junk debt sales for the year to date are already close to surpassing 2020’s record amount -- and the deals keep on coming. Investment grade issuance has slowed from the ferocious levels of debt-raising when the pandemic first struck, but activity throughout 2021 remained brisk right up until this week. September is looking no less busy.

Some are simply downing tools in an effort to get some rest.

“With the record amounts of deals this year fund managers are in need of a holiday,” said Uli Gerhard senior portfolio manager at Insight Investment Management. “The lack of staff and manpower is hindering the ability of teams to look at new deals at the moment, so naturally the market will be less active from here on in.”

A sure sign that investors are taking a break from their screens was the decision to postpone Thursday’s sterling transaction for Berkshire Hathaway’s Northern Powergrid (Northeast). The lead managers advised the market that the company was looking forward to re-engaging with investors after the summer.

Investment grade issuance stands at 981 billion euros ($1.15 trillion) year to date, just over 12% shy of last year at this point. Meanwhile, over 86.6 billion euros of junk corporate bonds have priced in 2021, around 2 billion euros short of 2020’s full year figure.

Some market players are soldiering on, arguing that there is too much uncertainty and too much going on in markets to take a break.

“The reflation trade is just too stuffed thanks to the Fed, delta variant, U.S. fiscal hopes, travel bans,” said Mark Nash, head of fixed income alternatives at Jupiter Asset Management.

An increased number of M&A transactions may still leave bankers stuck indoors as they come to the leveraged finance market for cash.

“With a strong pipeline in September, I can see people working through August,” said Jonathan Brownson, partner in Cahill Gordon and Reindel’s LLP’s capital markets and lending group.

“Some people would like a break but they’ll probably get less of a break just because it’s such a strong market,” he added. “I think people will do the deals that are in front of them.”

©2021 Bloomberg L.P.