May 13, 2019

As S&P 500 Stumbles, a Gold Miner Wins the Market

, Bloomberg News

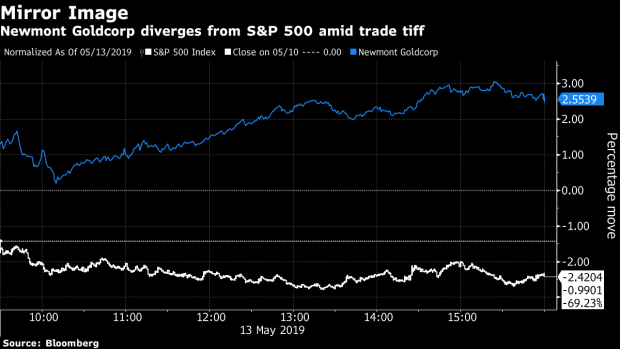

(Bloomberg) -- On a day in which U.S. President Trump’s trade war with China hammered stocks, the world’s largest gold miner was the S&P 500’s best performer, gaining more than the broader market lost.

But Newmont Goldcorp Corp.’s moment in the sun likely had little to do with its own merits and everything to do with its unique position, according to Josh Wolfson, an analyst with Desjardins Securities Inc.: “It’s the only gold stock on the S&P.”

Gold miners offer more leverage to rising gold prices, typically gaining more than spot on flight-to-safety trading days. For investors looking for a gold play on the S&P 500, there was only one option.

Rival Barrick Gold Corp. -- which bears the ticker ‘‘GOLD’’ -- rose 2.5%, about the same amount as newly merged Newmont Goldcorp (2.6%), but is not listed on the S&P 500. Neither is Agnico Eagle Mines Ltd., which gained 3%, or Kinross Gold Corp. which climbed 3.9%. Gold gained 1.1% as investors sought a haven from global trade turmoil.

A Newmont spokesman, Omar Jabara, declined to comment -- other than to say, “Thank you for noticing.”

To contact the reporter on this story: Danielle Bochove in Toronto at dbochove1@bloomberg.net

To contact the editors responsible for this story: Luzi Ann Javier at ljavier@bloomberg.net, Steven Frank, Joe Richter

©2019 Bloomberg L.P.