Sep 13, 2022

Asda, Iceland Bonds Climb Out of the Doldrums on Energy Bill Aid

, Bloomberg News

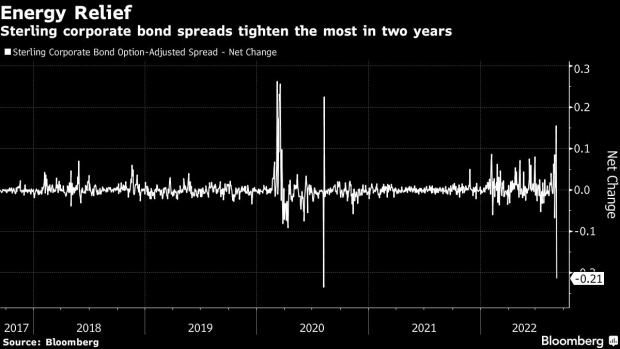

(Bloomberg) -- British supermarket chains Asda Group Ltd. and Iceland Foods Ltd. have seen their bonds move out of the distressed zone after British Prime Minister Liz Truss’s promised help on energy bills.

With Britons expected to have more money in their pockets to spend on essential groceries, the sweeping package of measures to contain spiraling energy bills announced last week has helped lift some concerns toward the sector. UK retail stocks have moved off recent lows, although remain volatile.

Asda’s bonds maturing in Feb 2026 have risen over 5 pence on the pound in the past week to move above 80 pence, according to data compiled by Bloomberg -- climbing over the threshold that investors consider to be distressed territory. Iceland’s March 2025 bonds have gained by a similar amount to around 80 pence in that time.

“The billions of pounds of fiscal support to alleviate pressure on households clearly helps all discretionary UK names,” said Justin Jewell, a high yield portfolio manager at BlueBay Asset Management LLP.

British supermarkets have had a torrid time in 2022, with 40-year high inflation, a weak sterling and Brexit-related supply chain issues pushing up their costs. But above all, the squeeze on household incomes has weighed most heavily, with the managing director of Iceland Foods quoted as saying that food banks were the main competition to the budget grocery chain.

While the measures are expected to help support consumer confidence, the outlook remains difficult. Grocery service Ocado Group Plc saw its shares tumble as much as 14% in London on Tuesday, after it warned that consumers were spending less as costs for energy weigh. Shares in J Sainsbury Plc., Tesco Plc. and Marks & Spencer Group Plc. were set for their first decline in three days.

Debt divergence

Iceland is especially exposed to refrigeration costs for its predominantly frozen food products, while its low-income client base is among the most exposed to a cost of living crisis. It has given its customers the option of paying for their food shopping in instalments.

Asda and Wm Morrison Supermarkets Plc. also face the risk of their bond yields rising faster than that of Tesco and Sainsbury’s, the other two members of the “big four” British supermarket chains. The additional debt that was piled onto their balance sheets by their private equity owners has weighed on the credit ratings of their bonds.

“I think this cycle we’re going to see a lot more divergence between names,” said Gordon Shannon, a portfolio manager at TwentyFour Asset Management LLP. “And being in a weaker position, lower quality and worse rated will definitely be punished.”

©2022 Bloomberg L.P.