Mar 2, 2023

Asia Earnings Week Ahead: JD, Trip.com, CATL, AIA, Cathay

, Bloomberg News

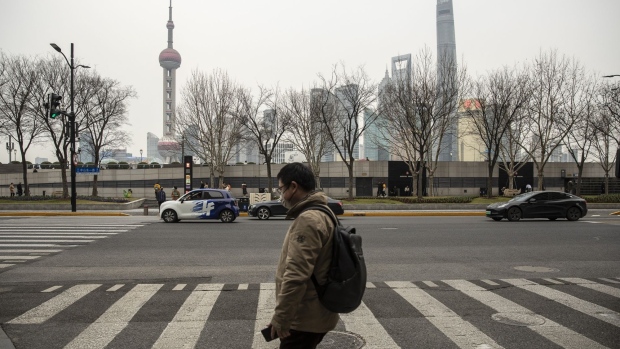

(Bloomberg) -- China set a modest economic growth target of around 5% for the year with a supportive spending plan. Economists expect that the actual growth will beat the new target after budgetary support and the end of Covid Zero.

Premier Li Keqiang said boosting domestic demand, a reference to consumer spending and business investment, would be the government’s top priority this year. Now investors are looking for catalysts in upcoming earnings.

Consumption-related firms, including JD.com and Trip.com, may provide more clues about the recovery with their earnings reports this week. JD.com’s numbers will be weighed against spending for its $1.5 billion subsidy campaign to beat back competition. EV battery maker CATL also reportedly offered rebates to some Chinese carmakers. Earlier, better-than-forecast results from companies like Alibaba and Baidu failed to overcome market concern about these expanding price wars.

Still, investors should shift the focus from reopening to potential recovery, according to Chief China Equity Strategist Kinger Lau at Goldman Sachs. Earnings growth is needed to drive further gains in Chinese equities as valuations are now back to a reasonable level, Lau added, expecting EPS growth for China to reach 17% this year.

So far, Chinese companies have reported relatively positive results compared with an overall disappointing quarter in the Asian region. Earnings of about 60% of MSCI ex-Japan Asia-Pacific companies missed estimates for the last quarter, while only 25% of them beat, according to Goldman Sachs estimates. 2023 earnings of the index have been revised down by 4%, dragged mostly by Korea and Taiwan markets or technology and energy sectors.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS function on the Bloomberg terminal.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the EMEA Earnings Week Ahead, and see the ESG Stock Watch for a selection of the environmental, social and governance themes that may come up on earnings calls.

Highlights to look for this week:

Monday: No major earnings expected.

Tuesday: Trip.com (TCOM US) is set to release its earnings before trading in Hong Kong. Full-year revenue is expected to jump 533% from a year earlier, according to Bloomberg consensus estimates. Fourth-quarter sales could recover to 60% of pre-pandemic levels in 2019 as international travel momentum is sustained and domestic travel reservations rebound in the second half of 4Q, Bloomberg Intelligence analysts Angela Hanlee and Tiffany Tam wrote in a note. Chinese visitors to Hong Kong could rebound to 78% of 2019 levels this year with the removal of daily traveler quota and mandatory Covid tests, accelerating earnings recovery, BI said. Analysts have already expected its R&D and administrative costs to return to normalized levels after stronger-than-expected 3Q results.

Wednesday: Cathay Pacific (293 HK) is due to report full-year earnings after the morning trading session. Amid a slow Covid-19 comeback, Hong Kong’s main airline is expected to report an annual net loss of HK$6.4 billion ($815 million) to HK$7 billion. That compares to the HK$5.5 billion loss in 2021. However, the group’s performance in the later part of the year should have given support to its results. Cathay’s passenger revenue likely more than tripled in the second half from a year earlier, Bloomberg Intelligence said in a report. That underlined a return to operating profit as demand rebounded with the reopening in Hong Kong and other Asian economies.

Thursday: JD.com (JD US) will announce its annual results after the market close in Hong Kong. Fourth-quarter revenue is expected to jump more than 21% sequentially, according to Bloomberg consensus estimates. JD.com has secured a unique market position as the second-largest online retailer in China because of its logistics and supply-chain network, which differentiates it from asset-light competitors including Alibaba, Bloomberg Intelligence analyst Cecilia Chan wrote in a note. The company is closing its Indonesia and Thailand e-commerce sites as it shifts the overseas strategy toward supply-chain and logistics services. JD.com is reportedly planning a $1.5 billion subsidy campaign to compete with budget shopping app Pinduoduo. While some investors were spooked by the intensifying price competition as it has the potential to severely depress profit margins, analysts consider it may drive new user and revenue growth for JD.

- Prada (1913 HK) is set to issue its report card for 2022 after market close. The luxury label is expected to enjoy a 55% year-on-year jump in net income for the year ended December and a near 20% sequential rise in 2023, according to Bloomberg consensus estimates. The January appointment of experienced outsider Andrea Guerra as CEO could strengthen product design with a younger generation, add a new focus and ignite the prospect of a secondary listing in Milan, Bloomberg Intelligent senior analysts Deborah Aitken and Andrea Ferdinando Leggieri wrote in a note. All regions outside China should have seen improved performance in 2022, namely Europe, US and the Middle East, extending strength, Aitken added.

- Contemporary Amperex Technology (300750 CH), one of the world’s biggest EV batteries maker, is due to report earnings after market close. The Fujian-based company reported 2022 preliminary net income of 29.1 billion yuan to 31.5 billion yuan, almost 20% higher than estimates as consumer demand for electric cars continues apace. The Chinese battery maker viewed domestic and foreign new energy sectors as developing rapidly, with continued growth in the battery and energy storage industry. CATL is also expanding overseas, including teaming up with Ford to build a battery manufacturing plant in Michigan. With the end of China’s Covid Zero policy lifting auto sales, the company’s profit strength could extend into this year after a 4Q beat, according to Bloomberg Intelligence analysts Steve Man and Joanna Chen.

Friday: AIA Group (1299 HK) will post its full-year results at around 6 a.m. Hong Kong time. The insurer is expected to suffer a 7% year-on-year decline in new business value for 2022, according to Bloomberg consensus estimates, as Covid restrictions in China and Hong Kong dampened sales. New annualized premiums might have fallen in Hong Kong and Singapore due to the high base a year earlier and market volatility that hampered demand on investments and savings-related products, according to Bloomberg Intelligence. The reopening in China will help boost AIA’s 2023 performance. According to a local media report citing its CEO for Hong Kong and Macau, the company plans to recruit 5,000 financial planning advisers and launch promotion campaigns at border control points to attract mainland Chinese customers.

--With assistance from Hideyuki Sano.

(Updates throughout.)

©2023 Bloomberg L.P.