Jul 8, 2021

U.S. stocks drop from records as bond rally quickens

, Bloomberg News

BNN Bloomberg's mid-morning market update: July 8, 2021

U.S. stocks dropped the most in almost three week amid growing anxiety that the spread of COVID-19 variants will upend growth expectations, undoing popular reflation trades. Treasuries gained for an eighth day.

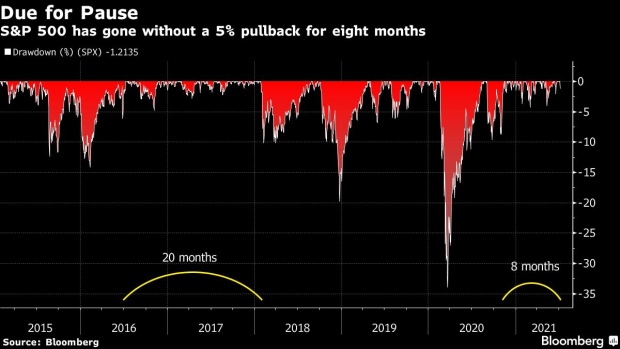

The S&P 500 fell 0.9 per cent, with the economically-sensitive industrial and material sectors helping to lead all 11 industry groups lower. The benchmark index had set all-time closing highs in eight of the last nine trading sessions. Banks were the biggest losers with the U.S. 30-year Treasury yields fell briefly below 1.90 per cent for the first time since February.

Traders are getting edgy over whether the rapid spread of the delta strain will knock back growth and prospects for central bank normalization.

“It feels like we have moved from thinking inflation will be transitory, to fearing growth will be transitory,” said Art Hogan, chief market strategist at National Securities.

Central bank stimulus plans remain critical to the market outlook. While the Federal Reserve mulls the timetable for tapering US$120 billion in monthly bond purchases, the European Central Bank stands ready to extend ultra-loose policy. In the culmination of an 18-month review published Thursday, ECB policy makers raised their inflation target to 2 per cent and said they would tolerate moderate overshoots.

“The minutes of the Fed yesterday pointed to a slowing of the bond purchase, though the lower interest rate on the 10-year, which indicated higher demand,” said Kim Forrest, founder and chief investment officer at Bokeh Capital Partners. It “looks like the bond people are ignoring the Fed’s future moves.”

Oil rebounded after a U.S. government report showed rapidly declining inventories and record-high fuel demand in the midst of the peak summer travel season.

Meanwhile, the pandemic’s global death toll has surpassed 4 million as the delta variant spreads, and the World Health Organization urged caution on reopenings worldwide.

Here are some events to watch this week:

- The Group of 20 finance ministers and central bankers meet in Venice on Friday

- China PPI and CPI data released on Friday

These are some of the main moves in markets:

Stocks

- The S&P 500 fell 0.9 per cent as of 4:01 p.m. New York time

- The Nasdaq 100 fell 0.6 per cent

- The Dow Jones Industrial Average fell 0.8 per cent

- The MSCI World index fell 1 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro rose 0.5 per cent to US$1.1847

- The British pound fell 0.1 per cent to US$1.3785

- The Japanese yen rose 0.8 per cent to 109.78 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.29 per cent

- Germany’s 10-year yield was little changed at -0.31 per cent

- Britain’s 10-year yield advanced one basis point to 0.61 per cent

Commodities

- West Texas Intermediate crude rose 1.3 per cent to US$73.13 a barrel

- Gold futures were little changed