Aug 21, 2022

Asia Gas Prices Jump After Russia Pipeline Maintenance Sends Europe to Record

, Bloomberg News

(Bloomberg) -- Asian liquefied natural gas prices extended gains as concern mounts that Russia’s announcement of maintenance on a key pipeline to Europe will further tighten global supplies.

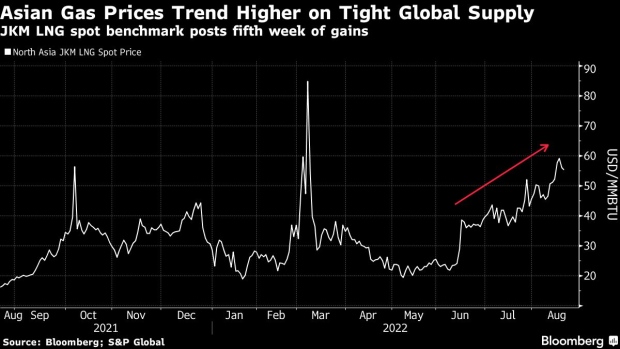

Producers offered LNG spot cargoes for winter above $60 per million British thermal units on Monday, traders said. The Japan-Korea Marker spot benchmark slipped 1.3% to $55.277 per million Btu on Friday before Gazprom PJSC’s announcement, they said, citing data from S&P Global.

Gazprom said Friday that it would stop the key Nord Stream pipeline for three days of maintenance on Aug. 31, helping push Europe’s benchmark price to a record. LNG traders in Asia have expressed concern that the link won’t return to service as planned, which would further tighten global markets after Russia progressively cut deliveries to Europe, its biggest customer.

Gazprom said Friday that shipments through the link under the Baltic Sea to Germany would be restored to current levels, equal to about 20% of capacity, “upon completion of the work and the absence of technical malfunctions.”

Asian spot LNG prices gained for five straight weeks and are trading at triple last year’s level. European gas futures surged on Monday on the Russia supply fears.

READ: Gazprom to Shut Pipeline for Three Days in New Shock to Europe

Utilities in Europe and Asia are in direct competition for LNG shipments from suppliers including the US, Qatar and Nigeria and traders are getting locked in bidding wars to attract cargoes. Japan and South Korea are currently looking to procure more spot LNG for winter, which has helped push prices to the highest level for this time of year.

Meanwhile, China may struggle to meet peak power demand following hydropower disruptions in the Sichuan region, Bloomberg Intelligence said Monday. BI expects both LNG and coal prices to continue rising in the near term.

Other spot market news:

- Sakhalin Energy, which operates the Sakhalin II project in Russia’s Far East, is considering releasing a tender offering to sell LNG cargoes for loading in Oct.-Dec.

Buy tenders:

Sell tenders:

©2022 Bloomberg L.P.