Jul 12, 2019

Asia’s Berkshire Hathaway Lacks Buffett’s Touch

, Bloomberg News

(Bloomberg Opinion) -- Just when China's conglomerates like HNA Group Co. are retreating from their overseas binges, Shanghai's Fosun International Ltd. still has its foot on the pedal.

On Friday, Fosun Tourism Group, the company’s travel unit, said it's in talks with Thomas Cook Group Plc's banks to inject 750 million pounds ($940 million) into the world's oldest travel agency. The deal would give Fosun’s unit control of the British company’s tour operations and a minority stake in its airline.

Fosun, which already owns about 18% of Thomas Cook, first paid 91.8 million pounds for a 5% stake in the U.K. tour operator in March 2015, just a month after ending a long-running saga to buy French resort operator Club Med. With both targets, Fosun aimed to tap into China’s booming outbound tourism industry.

This bet is a mistake – and not just because cash-strapped Chinese consumers may not feel like traveling much these days. It isn’t the first time Fosun has sunk money into Thomas Cook as shares of the British company tumbled. If anything, it highlights Fosun’s habit of throwing good money after bad, when the company doesn’t have much to spare.

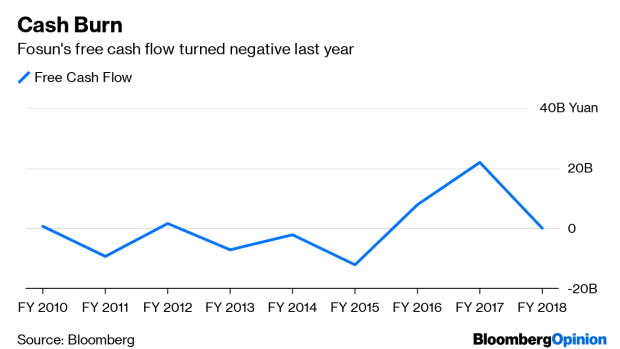

Fosun, a sprawling group with investments in everything from insurance to pharmaceuticals, has been called an Asian Berkshire Hathaway Inc. It’s anything but, as my colleague David Fickling has written. In the long run, a company has to cover the cost of its investments through operating cash. Yet Fosun – which, like Berkshire, has a huge insurance arm – is still borrowing to invest, and free cash flow was negative last year. In Warren Buffett’s empire, by contrast, portfolio companies’ operating cash flows easily offset investment spending.

Fosun has had some success tapping Hong Kong’s IPO market for funding. In December, the firm listed Fosun Tourism, whose holdings include Club Med, as well as Thomas Cook. Still, shares in the travel unit, which was unprofitable until last year, have fallen since.

Maybe being majority-owned by a Chinese company will turn things around for Thomas Cook. But it feels rather optimistic to think that penny-pinching Chinese consumers, facing a slowing economy, offer any more hope than Brexit-weary British travelers.

Fosun has been investing heavily as part of its mission to promote Chinese consumers' “health, happiness and wealth.” So far, that motto hasn't worked for Thomas Cook shareholders.

To contact the author of this story: Nisha Gopalan at ngopalan3@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Nisha Gopalan is a Bloomberg Opinion columnist covering deals and banking. She previously worked for the Wall Street Journal and Dow Jones as an editor and a reporter.

©2019 Bloomberg L.P.