Oct 2, 2022

Asia’s Factories Paint Uneven Recovery Picture in September

, Bloomberg News

(Bloomberg) -- The manufacturing industry deteriorated further across Europe last month because of the impact of the war in Ukraine, while factories in Asia painted a mixed picture.

The purchasing managers index for the 19-nation euro zone, a gauge of private-sector activity, fell to 48.4 from 49.6 in August. That’s slightly worse than S&P Global’s initial reading and marks the third consecutive month below the 50 threshold that separates expansion from contraction.

Readings for the euro area’s four biggest economies were also below this key level, highlighting the increasingly gloomy outlook for the region hardest hit by the conflict on its eastern border. A recession in the bloc is looking increasingly likely amid heightened threats of power restrictions.

“The ugly combination of a manufacturing sector in recession and rising inflationary pressures will add further to concerns about the outlook for the euro zone economy,” Chris Williamson, an economist at S&P Global, said on Monday. “Worse looks set to come, with orders slumping at a significantly steeper rate than production is being cut.”

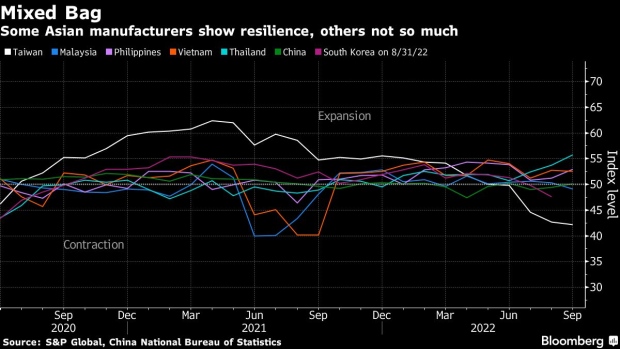

In Asia, factories displayed a split track of recovery in September, with manufacturing powerhouses in the north turning weak and key supply chain hubs in the south showing resilience amid China’s growth slowdown.

Gauges for much of Southeast Asia showed improvement, with Indonesia at 53.7, matching its January reading for the best this year. Thailand’s reading was a record high in data back to 2016, and the Philippines also edged up in September. Malaysia was a rare weakening in Southeast Asia, slipping to 49.1 after 50.3 in August.

North Asia revealed more of the pain in September PMIs. Taiwan and Japan eased from the prior month, with Taiwan’s PMI slumping to 42.2, its worst since the pandemic-era low in May 2020, according to S&P Global. South Korea’s PMI is set to be reported Tuesday.

The factory figures are one piece of an increasingly downbeat outlook for the global economy, with a wave of interest-rate hikes yet to defeat rampant inflation and growth concerns on the rise. China’s economic slowdown is starting to weigh more heavily on trade-reliant neighbors, and supply-chain backups have persisted worldwide.

Slumping demand for technology and semiconductors is hammering exports from Asia’s northeast manufacturing powerhouses including South Korea, Taiwan and Japan, and weighing on sentiment among producers.

Confidence among Japan’s large manufacturers unexpectedly worsened for three straight quarters following the yen’s rapid depreciation and worsening global economic outlook. An index of sentiment among the country’s biggest manufacturers declined to 8 in September from 9, according to the Bank of Japan’s quarterly Tankan report released Monday.

Companies are not expecting improvement “anytime soon,” as business confidence for the year ahead hit its second-lowest level on record, Annabel Fiddes, economics associate director at S&P Global Market Intelligence, said in a release. “This was driven be fears that global economic conditions will weaken further, and demand across key markets across Asia, Europe and the US will continue to decline in the months ahead.”

China’s official manufacturing purchasing managers index rose last month to 50.1 -- barely into expansion territory -- from 49.4 in August, according to a statement from the National Bureau of Statistics on Friday.

While China’s PMIs are showing nascent signs of bottoming, economists are warning that the brunt of the hit for Asia exporters is still to come. Factories in Taiwan saw the quickest drop in output and sales since May 2020 and inventories slumped at the fastest rate in over a decade.

US data and a global reading for manufacturing PMIs are due later on Monday.

©2022 Bloomberg L.P.