Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Latest Videos

The information you requested is not available at this time, please check back again soon.

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Whirlpool Corp., the owner of the Maytag and Amana appliance brands, is cutting about 1,000 salaried positions worldwide to reduce costs as slow US home sales limit demand.

Chicago Bears officials alongside Mayor Brandon Johnson unveiled plans for a $4.7 billion project to build a publicly owned, enclosed stadium and enhanced lakefront area.

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Blackstone Inc. and KKR & Co. mortgage real estate investment trusts are grappling with deteriorating office loans as higher interest rates and weak demand drive down property values.

May 24, 2020

, Bloomberg News

(Bloomberg) -- When China’s largest residential property developer raised money this month, a third of interest came from banks that service the wealthy, a group keeping faith with the nation’s beleaguered builders even as other investors flee.

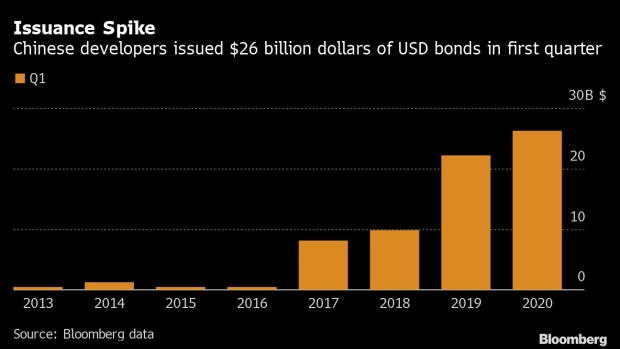

The affluent in Hong Kong and the mainland have piled in as Chinese developers sold a record $26 billion in U.S. dollar bonds in the first quarter and $1 billion since, brushing aside concerns that pushed junk-bond yields to an eight-year high in March.

Heightened interest from private bank clients and family offices is an important support as developers look to refinance or repay at least $20 billion of debt in a year of uncertain prospects for real estate. Lockdowns across Asia’s largest economy have forced more than 100 builders into bankruptcy and the swelling ranks of the unemployed are a continuing threat for the indebted sector. Still, there’s confidence that Beijing won’t allow a property collapse at a time of slowing economic growth.

“Yields are especially high this year, giving investors good returns as they bet on the long-term health of China’s property market,” said Andy Kowk, first vice president of wealth management at Guotai Junan Securities Hong Kong Ltd. “Wealthy investors from mainland China and Hong Kong are very substantial buyers of Chinese developer U.S. dollar bonds.”

Private banks made up 32% of preliminary orders for a bond offering from home builder Country Garden Holdings Co. last week, a person familiar with the matter said. They accounted for 10% of interest in Zhenro Properties Group Ltd.’s issuance, which helped reopen the high-yield bond market after a March sell-off made investors wary of junk-rated names.

Kowk has helped distribute bonds from firms including Country Garden, China Evergrande Group and Kaisa Group Holdings. Buyers ranged from those with $1 million in investable assets to ultra-high net worth investors, he said.

Private banks have subscribed to $4.9 billion of Chinese high-yield bonds so far this year, up 36% from the period last year, data compiled by Bloomberg from available deal statistics show. Debt issued by developers make up the bulk of China’s junk bond issuance.

The risks of such investments are apparent in the struggles of luxury home developer Tahoe Group Co., which is shaping up as the sector’s first major casualty of the coronavirus outbreak after saying it faces growing obstacles to repaying debt. It’s among builders hobbled by the virus after being weakened by buying restrictions meant to keep homes affordable.

Still, the offshore debt of the developers -- though typically high-yield -- tends to be safer than local paper. There have been only five defaults on offshore notes by firms with S&P Global ratings in the past decade.

Even so, developers are paying a premium to raise funds outside China, where markets are more volatile as they lack the liquidity support that’s steadied domestic yields, said Matthew Chow, a Hong Kong-based analyst at S&P.

Hermitage Capital, a family office in Hong Kong with $300 million in assets, has 80% of its investments in bonds, most from Chinese builders, said Chief Executive Officer Jin Zi. It has been buying dollar bonds issued by China’s top 50 property developers, he said.

“Government land auction prices continue to increase, but many developers are sitting on significant land banks, which they bought at relative cheap costs years ago,” Jin said. “Onshore lending rates for those developers are much cheaper than their offshore lending rate, so now is a great time to buy their U.S. dollar bonds.”

Yields on the junk-rated dollar bonds of Chinese real estate companies were more than 300 basis points higher on May 22 than a year earlier, according to data compiled by Bloomberg. Their three-to-five-year dollar debt offered a yield premium of about four percentage points over yuan-denominated paper, the data show.

“Chinese developers who are able to get a rating for offshore bonds are generally of better quality compared with those who can only do onshore issuance,” said Chow. “Many issuers have built a capital and refinancing buffer at a crucial time.”

©2020 Bloomberg L.P.