Dec 3, 2019

Asia Stock Futures Drop, Bonds Jump on Trade Worry: Markets Wrap

, Bloomberg News

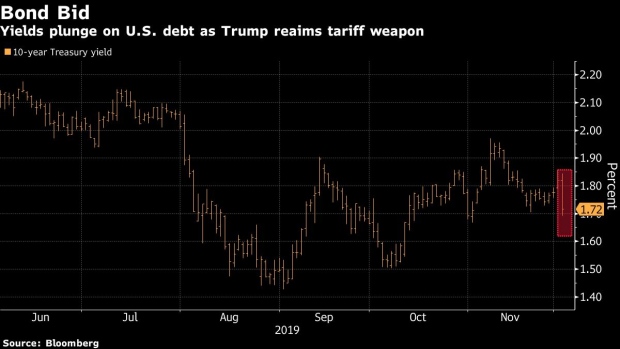

(Bloomberg) -- Stocks in Asia looked set for declines following a drop in U.S. equities and a surge in Treasuries in the wake of heightened uncertainty over this month’s upcoming tariff deadline.

Futures fell in Japan, Hong Kong and Australia. The S&P 500 Index declined for a third day, though it pared some of its losses in afternoon trading. The Trump administration signaled the U.S. plans to move forward with tariffs on Chinese goods if no deal is struck before the mid-December deadline. The president had earlier indicated he’d be willing to wait another year before striking an agreement with China. He also threatened levies on France after hitting steel from Brazil and Argentina.

Treasuries surged, driving yields down the most since August, as gold, the yen and the Swiss franc paced gains among haven assets. Australian bonds tracked the moves higher in early Wednesday trading.

“It’s very difficult to have conviction about which way the trade situation will go,” Laura Kane, head of Americas thematic investing at UBS Global Wealth Management, told Bloomberg TV. “Just a few weeks ago the news was incrementally positive, now we’ve moved more negative again, but the situation is going to stay in flux as we enter next year.”

Elsewhere, oil rose as traders focused on the upcoming OPEC+ meeting that could lead to deeper supply cuts by some of the biggest crude producers.

Here are some key events coming up this week:

- Australia’s GDP is due Wednesday.

- Germany releases factory-order data for October on Thursday.

- Saudi Aramco’s initial public offering is scheduled to be priced on Thursday, with Riyadh looking to raise more than $25 billion.

- Friday brings the U.S. jobs report, where estimates are for non-farm payrolls to rise by 190,000 in November.

These are the main moves in markets:

Stocks

- The S&P 500 fell 0.7%.

- Futures on Japan’s Nikkei 225 dropped 0.8%.

- Hang Seng futures earlier lost 1.2%.

- Futures on Australia’s S&P/ASX 200 Index declined 0.9%.

Currencies

- The yen rose 0.3% to 108.64 per dollar.

- The offshore yuan slid 0.4% to 7.0694 per dollar.

- The Bloomberg Dollar Spot Index decreased 0.1%.

- The euro was little changed at $1.1080.

Bonds

- The yield on 10-year Treasuries sank 10 basis points to 1.72%.

- Germany’s 10-year yield slid seven basis points to -0.35%.

- Australia’s 10-year yield fell 11 basis points to 1.09%.

Commodities

- West Texas Intermediate crude climbed 0.7% to $56.34 a barrel.

- Gold gained 1% to $1,477.45 an ounce.

--With assistance from Rita Nazareth and Vildana Hajric.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Andreea Papuc

©2019 Bloomberg L.P.