Dec 11, 2018

Asia Stock Traders Hit `Buy' as U.S.-China Trade Magic Is Back

, Bloomberg News

(Bloomberg) -- The power of news headlines is back, and a renewed dose of trade optimism is finally lifting Asian stocks from a six-week low.

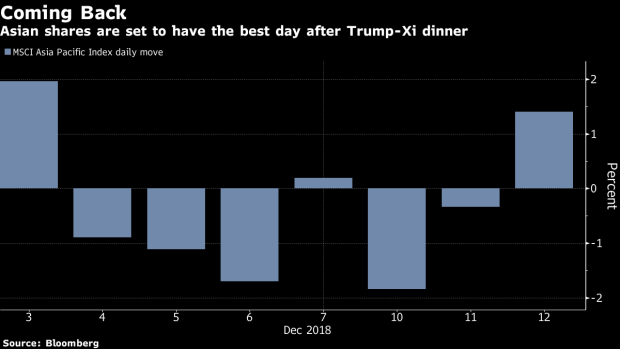

To be exact, the regional benchmark is heading for its biggest jump since Dec. 3, when the market reacted to Presidents Donald Trump and Xi Jinping’s famous dinner in Buenos Aires.

And on Wednesday, it’s again trade news that are providing the boost:

- Huawei Technologies Co.’s chief financial officer was granted bail on Tuesday, and U.S. President Donald Trump said he would intervene in the case if it would help win a trade deal with China. He told Reuters in an interview that the White House has spoken with the Justice Department about it, along with Chinese officials.

- There’s more solid news on the trade front, with a Bloomberg scoop that said there’s progress toward easing the steep tariffs China imposed on U.S. vehicle imports this year -- auto stocks including Toyota Motor rose Wednesday.

The MSCI Asia Pacific Index rose as much as 1.4 percent, and U.S. stock-index futures moved higher after a choppy morning. Japanese equities led the pack in Asia as the Topix index rallied more than 2 percent at one point, rebounding from an 18-month low Tuesday. Hong Kong stocks jumped, helped by a rally in developers shares.

The market is coming back to life just as trading volume is poised to dwindle with the holiday season approaching. It’s also a sign headlines on U.S.-China trade talks can still have a big impact.

As Bloomberg macro strategist Cameron Crise explains, the “stocks rally as optimism grows on China-U.S. trade” narrative is one investors have been “binge-watching” all year. He adds that the most bullish outcome is for a general decline in overall volatility instead of a “1% rally in Spooz overnight.”

But all of this doesn’t mean the market is out of the woods, according to Stephen Innes, head of trading at Oanda Asia Pacific Pte. Traders should continue to be sellers of risk assets as solving trade tensions is likely to be a “one step forward and two steps back” process, he said.

Brace for another volatile day in India after Congress won 113 seats in the state of Madhya Pradesh compared with 109 seats for Prime Minister Narendra Modi’s Bharatiya Janata Party. The nation also named a former bureaucrat who oversaw Modi’s controversial cash ban program as its new central-bank chief. The benchmark S&P BSE Sensex Index opened higher.

Here are some other news worth keeping an eye on:

- OPEC’s monthly Oil Market Report is due later, including demand and production estimates; follow the TOPLive blog for the news, analysis and market reaction.

- Bonitas Research said it’s short shares of Hengan International Group Co. because of concerns over its financial reporting and debt, according to an emailed report. The stock got suspended after plunging as much as 8.8 percent.

- Stocks of Hyundai Motor Group rose together after the conglomerate announced a reshuffle plan this morning.

Stock-Market Summary

- Japan’s Topix index up 1.9%; Nikkei 225 up 1.9%

- Hong Kong’s Hang Seng Index up 1.5%; Hang Seng China Enterprises up 1.6%; Shanghai Composite up 0.2%

- Taiwan’s Taiex index up 0.8%

- South Korea’s Kospi index up 1.1%; Kospi 200 up 1.2%

- Australia’s S&P/ASX 200 up 1.3%; New Zealand’s S&P/NZX 50 up 0.8%

- India’s S&P BSE Sensex Index up 0.8%; NSE Nifty 50 up 0.8%

- Singapore’s Straits Times Index up 0.9%; Malaysia’s KLCI up 0.7%; Philippine Stock Exchange down 0.3%; Jakarta Composite up 0.4%; Thailand’s SET up 0.4%; Vietnam’s VN Index up 0.5%

To contact the reporter on this story: Moxy Ying in Hong Kong at yying13@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Cecile Vannucci

©2018 Bloomberg L.P.