Aug 6, 2021

Stocks, treasury yields rise on robust jobs report

, Bloomberg News

BNN Bloomberg's mid-morning market update: August 6, 2021

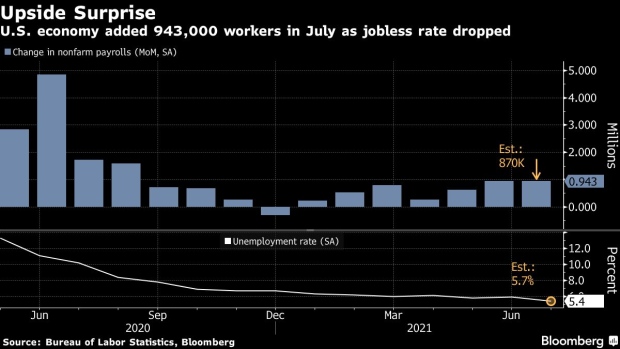

U.S. equities rose on Friday after a better-than-expected increase in U.S. payrolls fueled expectations that the Federal Reserve is moving closer to a pullback of stimulus.

The S&P 500 climbed to a record, led by financials and materials, while the technology-heavy Nasdaq 100 fell. U.S. job growth accelerated in July by the most in almost a year and the unemployment rate declined, illustrating momentum in the labor market as it grapples with hiring challenges.

The U.S. 10-year Treasury yield climbed to 1.3 per cent and the dollar strengthened against major peers.

“Today’s bumper payrolls report highlights a roaring recovery in the labor market and increases the chances of the Fed tapering their asset purchases sooner rather than later,” Mike Bell, global market strategist at JPMorgan Asset Management, said.

The report marked another step toward the Fed’s goal of “substantial” further progress in the labor market and rises expectations the central bank will start to cut back stimulus as it wrestles with inflation well above target. Dallas Fed President Robert Kaplan also added to the speculation Friday, saying he’d support adjusting purchases soon but in a gradual manner.

“I imagine the Fed wants to see another good report like this, but this is going to probably edge them a lot closer to tapering sooner,” said Kathy Jones, chief fixed income strategist for Schwab Center for Financial Research. “There’s not a lot to not like here.”

The jobs data showed continued momentum in the U.S.’s economic recovery and traders will be looking for data on price pressures next week and how hot inflation is running ahead of the Jackson Hole symposium later this month.

“When you rub all that together you have an economy that’s been in recovery for a year,” David Petrosinelli, senior trader at InspereX, said in a phone interview. “I think that’s going to force the Fed’s hand a little bit on being a bit more deliberate on the language vis-a-vis tapering to try to cool things down.”

The read-through on the report could also bode well for corporate earnings in the second half of the year, which has helped propel stocks to record highs as the economy recovers, Matt Peron, director of research at Janus Henderson Investors, said.

“Friday’s jobs report was strong on almost all measures, suggesting the economy continued its robust expansion despite recent delta fears,” he said. “Risks remain, but so far there are few signs of significant impact from the summer wave.”

Gold fell below US$1,800. Bitcoin rose to almost US$43,000 and WTI crude oil fell. Equities in Europe drifted higher while stocks in Japan gained and those in China fell.

These are the main moves in markets:

Stocks

- The S&P 500 rose 0.2 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.5 per cent

- The Dow Jones Industrial Average rose 0.4 per cent

- The MSCI World index fell 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.5 per cent

- The euro fell 0.6 per cent to US$1.1759

- The British pound fell 0.4 per cent to US$1.3877

- The Japanese yen fell 0.4 per cent to 110.23 per dollar

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 1.30 per cent

- Germany’s 10-year yield advanced four basis points to -0.46 per cent

- Britain’s 10-year yield advanced nine basis points to 0.61 per cent

Commodities

- West Texas Intermediate crude fell 1.4 per cent to US$68.13 a barrel

- Gold futures fell 2.6 per cent to US$1,762 an ounce