Jun 13, 2019

Asia Stocks Head for Mixed Start; Yields Retreat: Markets Wrap

, Bloomberg News

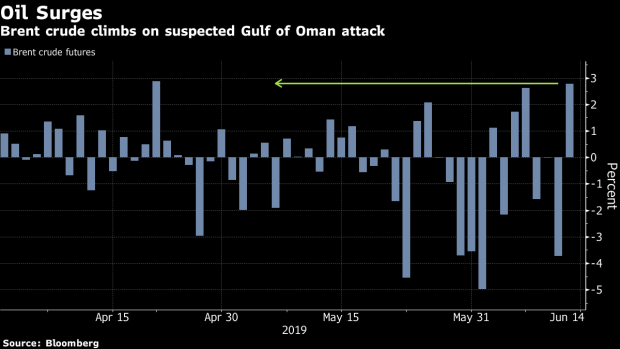

(Bloomberg) -- Stocks in Asia faced a muted start Friday after U.S. equities eked out gains and the global bond rally extended. Oil rallied on escalating Middle East tensions.

Futures pointed to modest gains for shares in Tokyo and Sydney, while Hong Kong contracts dipped. The S&P 500 Index reached a five-week high as a surprise increase in U.S. jobless claims supported the idea the Federal Reserve may cut rates, with the yield on 10-year Treasuries falling to 2.09%. Oil jumped after two tankers were damaged in suspected attacks near the Persian Gulf. The U.S. blamed Iran. The dollar was flat, remaining in a tight range.

With heightened U.S.-China trade tensions threatening to weaken already fragile global economic growth, equity investors are banking on more support from central banks. The odds of the Fed shocking markets next week and lowering the fed funds rate target are higher than many expect, according to BMO strategists. Chinese data for May due Friday will show how the economy is coping with higher U.S. tariffs.

“What’s important to remember right now is that there aren’t a whole lot of upside catalysts,” Randy Frederick, vice president fort trading and derivatives at Charles Schwab & Co., told Bloomberg TV. “Markets are waiting now for what the Fed is going to say at the meeting and that’s coming next week.”

Elsewhere, oil producers were buoyed by the surge in crude prices. The tanker incident follows other attacks in the region last month.

These are the main moves in markets:

Stocks

- Futures on Japan’s Nikkei 225 rose 0.3% in Singapore.

- Hang Seng futures slipped 0.2%.

- Futures on Australia’s S&P/ASX 200 Index added 0.1%.

- The S&P 500 Index rose 0.4%.

Currencies

- The yen was at 108.38 per dollar.

- The offshore yuan held at 6.9295 per dollar.

- The Bloomberg Dollar Spot Index was little changed.

- The euro bought $1.1278.

Bonds

- The yield on 10-year Treasuries fell three basis points to 2.09%.

Commodities

- West Texas Intermediate crude gained 2.1% to $52.20 a barrel.

- Gold was flat $1,342.36 an ounce.

--With assistance from Vildana Hajric, Brendan Walsh, Jeremy Herron and Abigail Doolittle.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.