Feb 21, 2019

Asia Stocks Look Set to Slip; Treasuries Decline: Markets Wrap

, Bloomberg News

(Bloomberg) -- Asian stocks looked set for modest losses following a weak U.S. session as investors mulled an uncertain economic backdrop and mixed signals on trade negotiations. Treasury yields jumped.

Futures in Japan, Hong Kong and Australia pointed lower after weaker than expected data from Europe and the U.S. reignited worries about the world economy. U.S. durable goods orders were below expectations and home sales missed estimates. The dollar edged higher amid reports signaling uneven progress in U.S.-China trade talks as next week’s deadline for more tariffs nears. The Aussie recouped some losses after the nation’s Treasurer said China had not banned its imports.

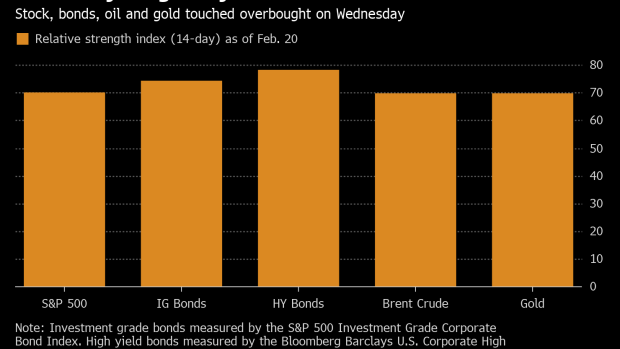

The weakness in equities comes after the MSCI’s global gauge of stocks surged 15 percent in less than two months on optimism over a U.S.-China trade agreement. Despite increasing confidence a deal can be done, investors shouldn’t expect the stellar run for risk assets to continue at this pace, said Richard Turnill, global chief investment strategist at BlackRock.

“Don’t chase the rally,” Turnill told Bloomberg TV. “Don’t extrapolate the double-digit gains we’ve seen in the first six weeks of this year.”

In focus on Friday will be parliamentary testimony from Reserve Bank of Australia Governor Philip Lowe, then European Central Bank President Mario Draghi will speak later in the day.

Elsewhere, West Texas oil fell below $57 a barrel after an industry report showed American crude stockpiles continue to swell. In Europe, lenders led shares lower as minutes of the latest ECB meeting showed policy makers setting up their March gathering as a key session to render their verdict on a regional slowdown and whether new long-term bank funding is required.

And these are the main moves in markets:

Stocks

- Futures fell 0.4 percent on Japan’s Nikkei 225.

- The S&P 500 Index dropped 0.4 percent.

- Hang Seng futures earlier slid 0.5 percent.

- Futures on Australia’s S&P/ASX 200 Index fell 0.1 percent.

Currencies

- The yen gained 0.1 percent to 110.71 per dollar.

- The offshore yuan slipped 0.1 percent to 6.7247 per dollar.

- The Bloomberg Dollar Spot Index rose 0.1 percent.

- The euro was steady at $1.1333.

- The British pound slipped 0.1 percent to $1.3035.

Bonds

- The yield on 10-year Treasuries advanced four basis points to 2.69 percent.

Commodities

- Gold declined 1.1 percent to $1,323.01 an ounce.

- West Texas Intermediate crude fell 0.7 percent to $56.77 a barrel.

--With assistance from Brandon Kochkodin.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.