Aug 18, 2019

Asia Stocks Set to Start Week Higher; Yen Flat: Markets Wrap

, Bloomberg News

(Bloomberg) -- Stocks in Asia were set for gains Monday following a bounce in U.S. equities as traders kick off a busy week for economic data and await commentary from the Federal Reserve chief.

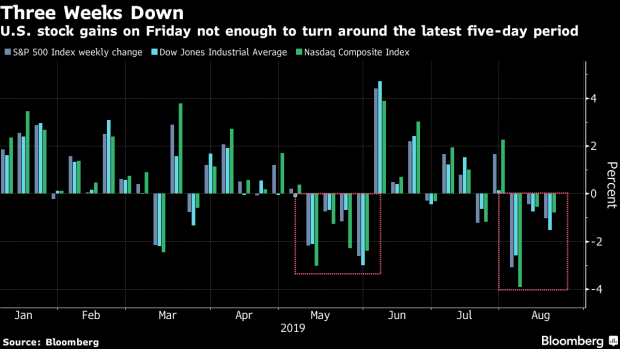

Futures pointed higher in Japan, Hong Kong and Australia. The S&P 500 closed higher helped by speculation European officials will bolster stimulus if growth in the region continues to sputter. Treasuries yields recovered from multiyear lows Friday, after an inversion in the yield curve earlier in the week. The yen and yuan were steady early Monday.

With market volatility soaring in August, Federal Reserve chair Jerome Powell’s address at the Kansas Fed’s annual Jackson Hole gathering on Friday will be key to gauging whether U.S. policy makers will add to July’s rate cut. Developments in the trade war continue to keep investors on edge and Larry Kudlow said recent phone calls between U.S. and China negotiators had produced “positive news.”

This week investors will also be watching out for purchasing managers data from the U.S. and euro-area. Those in Asia are keeping a close eye on Hong Kong, where a peaceful protest at the weekend appeared to be the largest in over a month.

Here are some notable events coming up:

- Minutes of the Fed’s July meeting will provide details on the discussions leading to the first interest-rate cut in a decade when they are released on Wednesday.

- Thursday brings the Bank Indonesia rate decision and press conference with Governor Perry Warjiyo.

- Kansas City Federal Reserve Bank hosts its annual central banking symposium in Jackson Hole, Wyoming, starting Thursday. Fed chair Jerome Powell will give remarks on Friday.

- Flash PMIs are due for the euro area on Thursday.

Here are the main moves in markets:

Stocks

- The S&P 500 Index gained 1.4%.

- Futures on Japan’s Nikkei 225 rose 0.8%.

- Hang Seng futures earlier advanced 0.2%.

- Futures on Australia’s S&P/ASX 200 Index added 0.6%.

Currencies

- The yen rose 0.1% to 106.22 per dollar.

- The offshore yuan dipped 0.1% to 7.0496 per dollar.

- The euro was flat at 1.1093.

Bonds

- The yield on 10-year Treasuries rose two basis points to 1.55%.

Commodities

- West Texas Intermediate crude rose 0.7% to $54.87 a barrel.

- Gold futures decreased 0.6% to $1,513.52 an ounce.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.