Jan 25, 2022

U.S. market rebound fails and futures plunge on earnings

, Bloomberg News

We expect growth will come back with a little more volatility: Som Seif

An afternoon rebound for stocks proved short-lived, with major averages ending lower as investors remained on edge over the Federal Reserve’s inflation-fighting stance and Russia’s saber-rattling against Ukraine. Selling worsened after the close as disappointing tech earnings sent futures plunging.

In another jittery session, the S&P 500 closed at the lowest since October, with technology shares weighing heavily on the market. The gauge briefly erased losses as dip buyers resurfaced to snap up bargains after a slide of nearly 3 per cent earlier in the day. Unlike Monday, the index failed to stage a dramatic comeback. In fact, there have never been two consecutive sessions when it drew down at least 2 per cent from the previous day’s close to finish higher, according to data compiled by Bloomberg going back to the early 1980s. In late trading, an exchange-traded fund tracking the Nasdaq 100 plunged more than 1.5 per cent after Microsoft Corp. reported a slowdown in cloud growth.

The risk of a “growth shock” to equities is increasing, according to Goldman Sachs Group Inc. strategists. Ahead of Wednesday’s Fed decision that’s expected to point toward a rate hike in March, they warned that sharp monetary tightening to tame inflation could eventually have knock-on effects on economic activity, hurting stocks. The International Monetary Fund cut its world growth forecast for 2022, citing weaker prospects for the U.S. and China along with persistent inflation.

Comments:

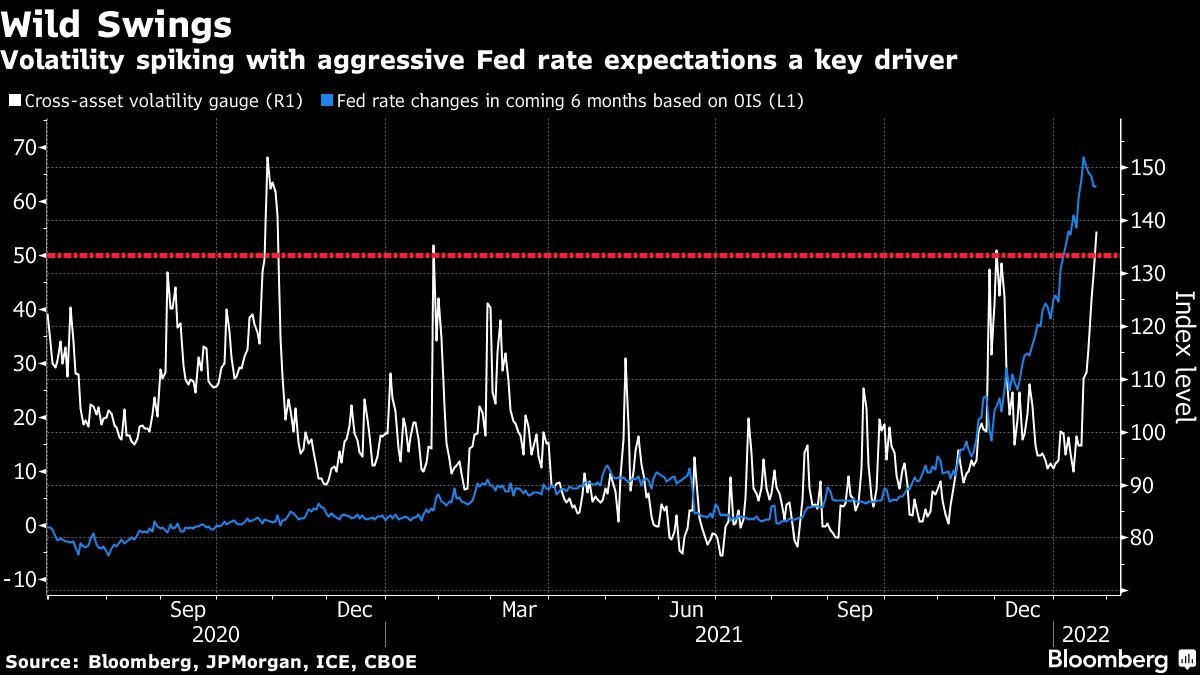

- “Volatility is back. We’re having a sea-change in terms of Fed policy. Equity investors frankly have been behind the curve in anticipating what’s coming, so there’s a lot of catch-up to do,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, told Bloomberg Television

- “When everyone is wondering what the state of the world is, you are exposed to these extreme movements in price action that have no fundamental catalyst. The bad thing is that can take you off in a direction that’s very scary,” said Mike Zigmont, head of trading and research at Harvest Volatility Management.

- “Is it time to dive into the market wholesale? I don’t think quite yet. I’m looking for the Fed to actually begin liftoff to sort of usher in an era of perhaps modestly less volatility than we’ve experienced in January,” Kate Moore, BlackRock global allocation team head of thematic strategy, told Bloomberg Television.

On the geopolitical front, Deputy Treasury Secretary Wally Adeyemo said the U.S. and its European allies have economic sanctions “at the ready” in case Russian troops invade Ukraine. A Kremlin spokesman warned that a White House move to put as many as 8,500 troops on alert “exacerbates tensions,” while top Biden administration officials said reinforcements for North Atlantic Treaty Organization forces in Eastern Europe and potential sanctions on Russia are ready to go.

Corporate highlights:

- International Business Machines Corp. reported revenue that beat estimates, buoyed by strong demand in the software unit.

- American Express Co. raised forecasts for revenue and profit after spending on its cards surged to a record.

- Health-care giant Johnson & Johnson projected 2022 earnings and sales above Wall Street’s expectations.

- General Electric Co. missed sales expectations for the fourth quarter as it grappled with worsening supply-chain pressures.

- Nvidia Corp. is quietly preparing to abandon its purchase of Arm Ltd. from SoftBank Group Corp. after making little to no progress in winning approval for the US$40 billion chip deal, according to people familiar with the matter.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.2 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 2.5 per cent

- The Dow Jones Industrial Average fell 0.2 per cent

- The MSCI World index fell 0.9 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2 per cent to US$1.1303

- The British pound rose 0.1 per cent to US$1.3508

- The Japanese yen was little changed at 113.89 per dollar

Bonds

- The yield on 10-year Treasuries was little changed at 1.78 per cent

- Germany’s 10-year yield advanced three basis points to -0.08 per cent

- Britain’s 10-year yield advanced four basis points to 1.16 per cent

Commodities

- West Texas Intermediate crude rose 2.5 per cent to US$85.38 a barrel

- Gold futures rose 0.3 per cent to US$1,850.10 an ounce