Jun 16, 2021

Yields jump on rate outlook; stocks pare losses

, Bloomberg News

Fed to Initiate Tapering Discussion, JPMorgan's Hui Says

Bond yields jumped and stocks fell for a second day after Federal Reserve officials signaled they’ll begin dialing back the stimulus that has fueled the recovery from the pandemic.

Stocks closed off the lows of the day after Fed Chair Jerome Powell downplayed the risk of an immediate rate increase. The S&P 500 index had initially tumbled when policymakers disclosed that they expect two interest rate increases by the end of 2023. The dollar strengthened versus major peers. Yields on benchmark 10-year Treasury notes rose from an almost three-month low, while five- and seven-year notes fell more as the market repriced the timing of rate increases.

Crude oil edged lower after earlier rising as much as 1.2 per cent in New York as the strengthening dollar reduced the appeal of commodities priced in the currency.

“First blush is obviously a hawkish read,” said Michael Contopoulos, Richard Bernstein Advisors LLC’s director of fixed income and portfolio manager. “This supports the reflation, higher rates theme and likely adds more fuel to the taper talk fire for Jackson Hole or September FOMC at the latest.”

The central bank held the target range for its benchmark policy rate unchanged at zero to 0.25 per cent -- where it’s been since March 2020 -- and pledged to continue asset purchases at a US$120 billion monthly pace until “substantial further progress” had been made on employment and inflation.

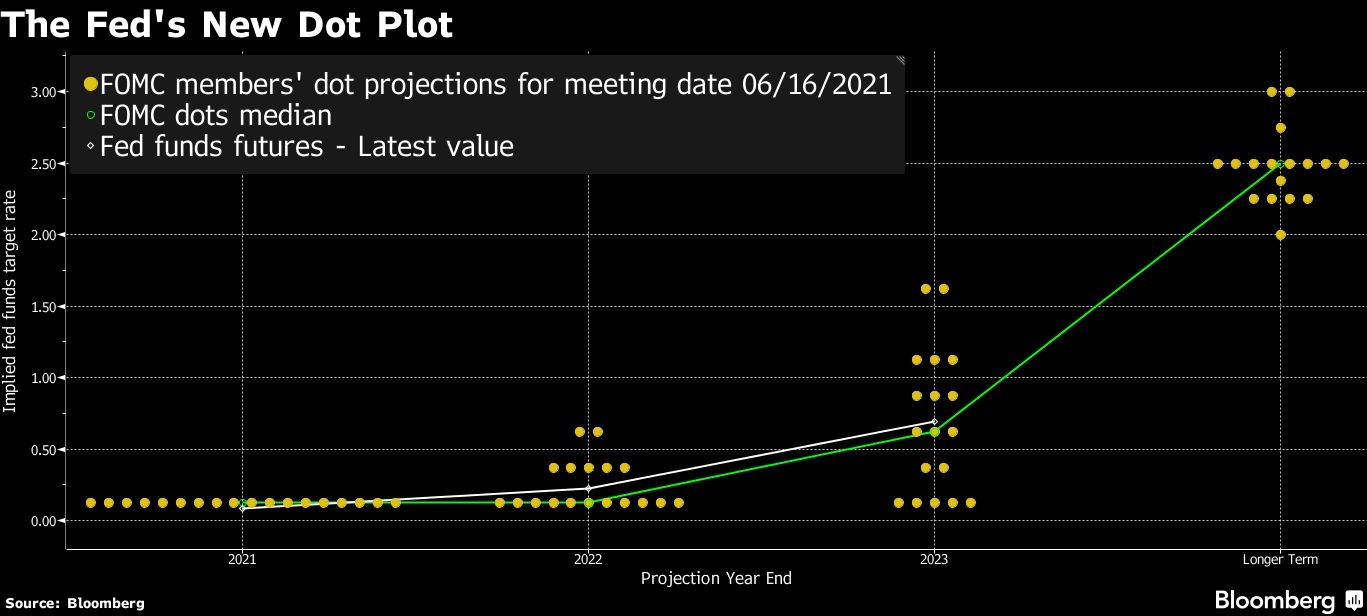

The quarterly projections showed 13 of 18 officials favored at least one rate increase by the end of 2023, versus seven in March. Eleven officials saw at least two hikes by the end of that year. In addition, seven of them saw a move as early as 2022, up from four.

“The number of people who moved forward into 2023 is somewhat surprising,” said Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management Co.

In a press conference after the rate decision announcement, Powell appeared to throw some cold water on the market’s initial reaction to the dot plot revision -- by going to some lengths to explain that the central bank isn’t really thinking about rate increases right now.

“The Fed didn’t rock the boat,” said Ryan Detrick, chief market strategist at LPL Financial. “They increased their inflation outlook and upped GDP forecasts, everyone expected that. Yes, the first hike will now be in 2023, but again, this shouldn’t have been a surprise to anyone.”

Here are some key events to watch this week:

- U.S. Treasury Secretary Janet Yellen testifies before a House panel Thursday on the federal budget

- Rate decisions come from Switzerland and Norway on Thursday

- The Bank of Japan’s monetary policy decision is on Friday

These are some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5 per cent, more than any closing loss since May 18 as of 4:02 p.m. New York time

- The Nasdaq 100 fell 0.3 per cent to the lowest since June 10

- The Dow Jones Industrial Average fell 0.8 per cent, more than any closing loss since May 18

- The MSCI World index fell 0.6 per cent at 4:02 p.m. New York time, the most since June 3

Currencies

- The Bloomberg Dollar Spot Index rose 0.8 per cent, more than any closing gain in about a year

- The euro slipped 1 per cent, more than any closing loss in about 15 months

- The British pound slipped 0.6 per cent, more than any closing loss since May 12

- The Japanese yen slipped 0.5 per cent, more than any closing loss since June 3

Bonds

- The yield on 10-year Treasuries advanced eight basis points, more than any closing gain since March 12

- Germany’s 10-year yield declined two basis points to -0.25 per cent

- Britain’s 10-year yield declined two basis points to 0.74 per cent

Commodities

- West Texas Intermediate crude fell 0.4 per cent to US$71.84 a barrel

- Gold futures fell 1.4 per cent, falling for the fourth straight day, the longest losing streak since April 30