Jul 11, 2019

Asia Stocks to Trade Mixed; Treasuries Slide: Markets Wrap

, Bloomberg News

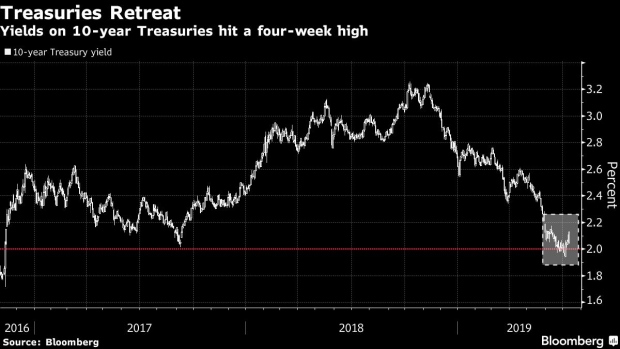

(Bloomberg) -- Stocks in Asia headed for a mixed start Friday as trade-tensions resurfaced and U.S. shares closed at a record. Treasuries tumbled after the latest American inflation reading came in above expectations.

Futures were flat in Tokyo and pointed to declines in Hong Kong and Australia. The S&P 500 eked out a third straight gain after drifting much of the session. A tweet from President Donald Trump, complaining about China trade policy, sent equities into a fleeting swoon and showed how sensitive the market remains to trade-related developments. Yields on 10-year Treasuries hit a one-month high.

“The Trump tweet combined with better than expected U.S. inflation and labor data gave good reason for equities traders to close up shop for the day,” Edward Moya, senior market analyst at Oanda, wrote in a note. “Powell’s testimony on Thursday was mostly a reiteration and we could be in store for lackluster moves heading into Asia.”

While the risk-asset rally got a fresh boost on the back of dovish comments from Fed Chair Jerome Powell, the strong CPI print Thursday offers a potential complication to U.S. policymakers prior to its decision at the end of the month. Traders pulled back bets on a half-point cut in July after the inflation data.

Elsewhere, a rally in oil stalled as investors weighed the threat of a tropical storm off the U.S. Gulf Coast against the prospects of more trade conflict. The pound continued its rebound from a two-year low as the greenback fell.

Here are the main moves in markets:

Stocks

- The S&P 500 Index rose 0.2% Thursday.

- Futures on Japan’s Nikkei 225 were little changed in Singapore.

- Hang Seng futures earlier dipped 0.4%.

- Futures on Australia’s S&P/ASX 200 Index fell 0.4%.

Currencies

- The yen was at 108.49 per dollar.

- The offshore yuan held at 6.8764 per dollar.

- The Bloomberg Dollar Spot Index dipped 0.1%.

- The euro bought $1.1256.

- The British pound edged up to $1.2528.

Bonds

- The yield on 10-year Treasuries climbed eight basis points to 2.14%, the highest in four weeks.

Commodities

- West Texas Intermediate crude held at $60.43 a barrel.

- Gold was at $1,403.83 an ounce.

--With assistance from Vildana Hajric and Olivia Rinaldi.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.