May 22, 2018

Asian Futures Fall on North Korea Summit Doubts: Markets Wrap

, Bloomberg News

(Bloomberg) -- Asian stocks are set for a lower open after declines in U.S. shares, as geopolitical tensions came back to the fore to outweigh easing trade strains. The dollar fell, Treasuries were steady and crude retreated from the highest since November 2014.

Equity futures fell in Japan, Australia and Hong Kong. U.S. stocks erased earlier gains after President Donald Trump cast doubt on a possible summit with North Korea during his Oval Office meeting with South Korea President Moon Jae-in. Wall Street stocks had rallied earlier following China’s announcement that it will cut the import duty on passenger cars, signaling a further easing of trade tensions with the U.S.

Beyond geopolitics, central banks are also in focus this week. The Federal Reserve will release minutes of its latest policy meeting on Wednesday, while the ECB follows suit on Thursday. A raft of U.S. debt sales adds to the busy agenda.

Elsewhere, the euro edged lower as investors weighed the chances that Italy’s president will seek to curtail a potential populist government, while the country’s bonds rebounded from a two-day slide. The Turkish lira sank to yet another record low. Sterling strengthened amid speculation there could be another U.K. election and after upbeat comments from a Bank of England policy maker.

Terminal users can read more in Bloomberg’s Markets Live blog.

These are some key events to watch this week:

- The Federal Reserve releases minutes of the central bank’s May 1-2 meeting on Wednesday; U.S. new home sale are due as are euro-area and Japan PMIs.

- Thursday sees the Bank of England Markets Forum at Bloomberg London. Speakers include BOE Governor Mark Carney and New York Fed President William Dudley.

- At the St. Petersburg Forum Friday, Russian President Vladimir Putin and French President Emmanuel Macron, IMF Managing Director Christine Lagarde, and Japan Prime Minister Shinzo Abe participate on a panel moderated by Bloomberg News Editor-in-Chief John Micklethwait.

- Also Friday, European Union finance ministers discuss the latest on Brexit talks, in Brussels.

These are the main moves in markets:

Stocks

- Futures on the Nikkei 225 Stock Average fell 0.2 percent in Singapore.

- S&P/ASX 200 Index futures fell less than 0.1 percent.

- Hang Seng Index futures dropped 0.2 percent.

- S&P 500 Index futures fell less than 0.1 percent as of 7 a.m. in Tokyo. The S&P 500 fell 0.3 percent.

- The MSCI Emerging Market Index increased 0.7 percent, the largest gain in more than a week.

Currencies

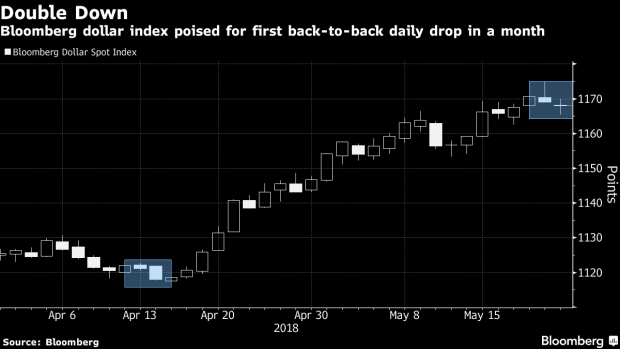

- The Bloomberg Dollar Spot Index decreased 0.1 percent.

- The euro declined 0.1 percent to $1.1779.

- The British pound added less than 0.1 percent to 1.3433.

- The Japanese yen rose 0.2 percent to 110.88 per dollar.

- The Turkish lira sank 2.1 percent to 4.6728 per dollar, the weakest on record.

Bonds

- The yield on 10-year Treasuries was little changed at 3.0597 percent.

Commodities

- West Texas Intermediate crude slid 0.2 percent to $72.13 a barrel.

- Gold fell 0.1 percent to $1,291.87 an ounce.

- LME spot copper jumped 1.6 percent to $6,950.25 a metric ton.

--With assistance from Sarah Ponczek and Greg Chang.

To contact the reporter on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2018 Bloomberg L.P.