Dec 22, 2019

Asian Stocks Seen Mixed Ahead of Holiday Break: Markets Wrap

, Bloomberg News

(Bloomberg) -- Asian shares are expected to start the week mixed with volumes remaining subdued as investors count down to the holiday break. Currencies were little changed in early Asian trading.

Futures ticked higher in Japan and fell in Sydney, while Hong Kong contracts were little changed. U.S. equities finished last week at a record high, the S&P 500 Index had its biggest weekly gain since September and was on pace to gain 28% this year.

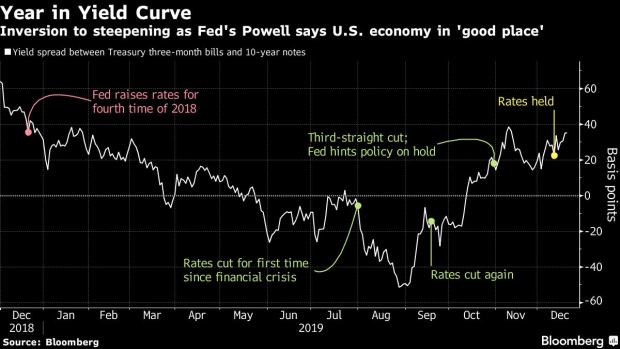

Ten-year Treasuries gained Friday and the yield curve remained near its steepest in more than a year, underscoring how recession worries have receded.

Meanwhile, the signing of the first-phase of the U.S.-China trade deal was set for January, calming investors’ nerves. U.S. President Donald Trump’s impeachment has morphed into a standoff, yet U.S. lawmakers managed to pass spending bills Thursday to avoid a partial government shutdown.

And while the logjam in U.K. politics is over, the prospect of a messy break from the European Union is back on the agenda. The pound saw its worst weekly decline in more than two years amid concern that Prime Minister Boris Johnson and EU negotiators will struggle to agree a trade deal next year.

These are the main moves in markets:

Stocks

- Nikkei 225 futures rose 0.3% in Singapore.

- Australia’s S&P/ASX 200 Index futures fell 0.4%.

- Hong Kong’s Hang Seng Index futures were little changed.

- The S&P 500 Index increased 0.5% Friday.

Currencies

- The Japanese yen traded at 109.45 per dollar.

- The offshore yuan was at 7.0013 per dollar.

- The Bloomberg Dollar Spot Index gained 0.2% Friday.

- The euro was at $1.1082.

- The pound traded at $1.3006.

Bonds

- The yield on 10-year Treasuries decreased less than one basis point to 1.92%.

Commodities

- West Texas Intermediate crude declined 1.2% to $60.44 a barrel.

- Gold rose 0.2% to $1,481.64 an ounce.

To contact the reporter on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Virginia Van Natta

©2019 Bloomberg L.P.