May 11, 2021

Stocks tumble the most since February; yields jump

, Bloomberg News

BNN Bloomberg's mid-morning market update: May 12, 2021

The S&P 500 Index slumped the most since February and bond yields jumped after a report showed inflation rose more than forecast, adding to concern that price pressures will stifle a recovery in the world’s biggest economy.

The technology sector continued to lead the retreat in equities, with Apple and Microsoft pacing a 2.6 per cent decline in the Nasdaq 100. Cathie Wood’s ARK Innovation ETF resumed its slide, bringing this year’s loss to about 18 per cent. After closing at a record high on Friday, the benchmark S&P 500 dropped 2.14 per cent. Energy was the only one of the 11 industry sectors to finish in the green. Treasury yields surged the most since March.

“The markets have been hovering around all-time highs with a lot of the reopening trade already priced in,” said Mike Loewengart, managing director of investment strategy at E*Trade Financial. “So it’s not out of the question that the outsized inflation read could bring us back down to earth a bit.”

The debate over whether inflation will be persistent enough to force the Federal Reserve to tighten policy sooner than current guidance suggests comes as abundant stimulus has powered a rally in global equities, raising concerns valuations had become expensive. Fed Vice Chair Richard Clarida said he was surprised by the rise in consumer prices and “we would not hesitate to act” to bring inflation down to its goals if needed.

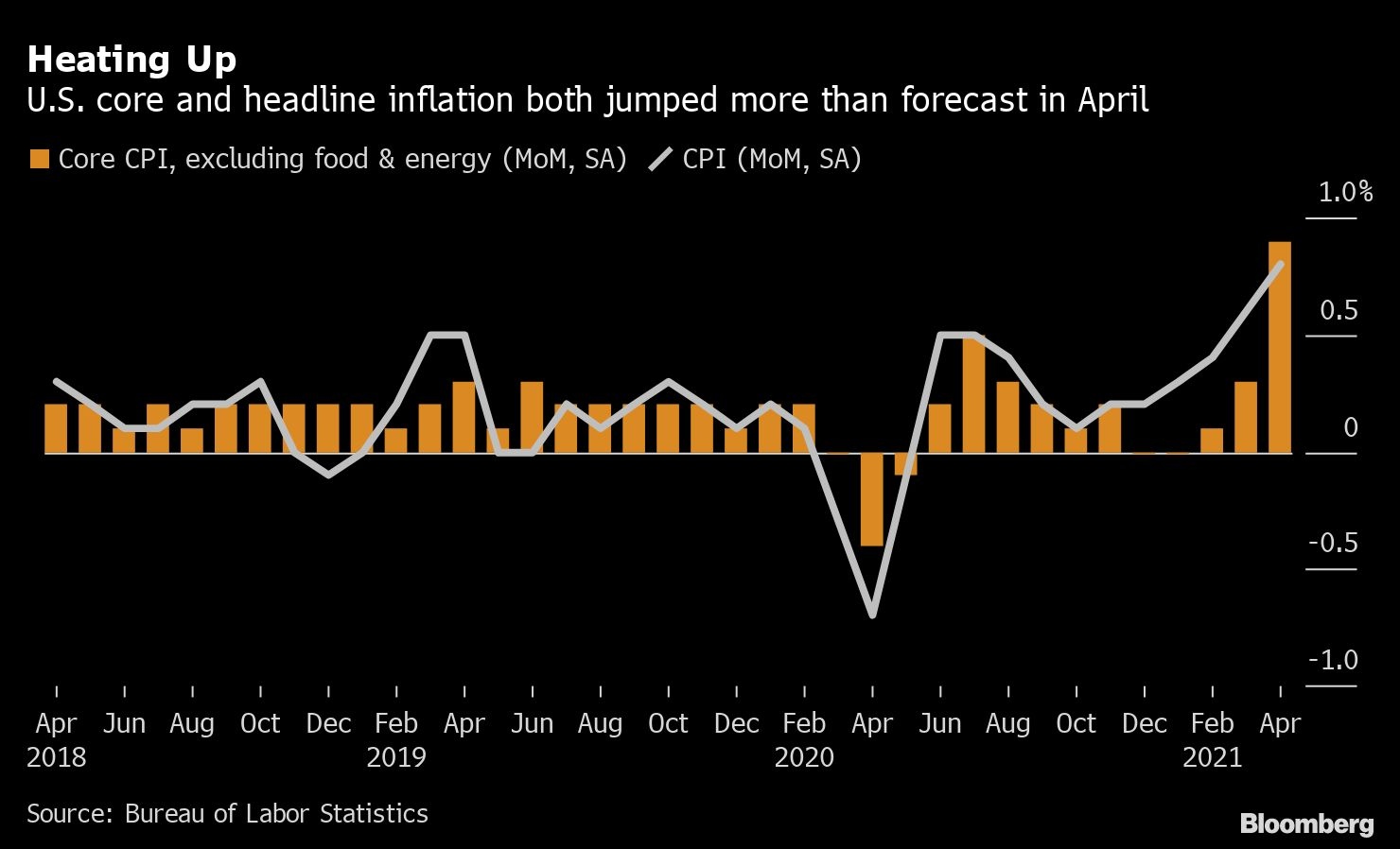

The consumer price index increased 0.8 per cent from the prior month after a 0.6 per cent gain in March. Excluding the volatile food and energy components, the so-called core CPI rose 0.9 per cent from March.

“The CPI data point feeds into a myopic narrative that the U.S. is overheating and the Fed is one step away from tightening,” said Mike Bailey, director of research at FBB Capital Partners. “Bears will feast on this tightening theme in the short term, but my sense is inflation will prove fleeting and markets will revert back to a more bullish view of moderate growth and lower risk of Fed tightening until we get to a full recovery.”

Elsewhere, the claim among advocates that Bitcoin is an inflation hedge appears to be in question after the CPI report. The digital asset slumped as much as 5.8 per cent to around US$53,600.

European stocks closed mostly higher, lifted by optimism about economic re-openings and booming commodities.

Copper and iron ore were on course for new records amid a broadening commodities boom. Oil was steady above US$65 per barrel. The biggest U.S. pipeline is still closed in the wake of a cyberattack, leading to acute fuel shortages in some parts of the nation.

These are some of the main moves in markets:

Stocks

- The S&P 500 fell 2.1 per cent, more than any closing loss since Feb. 25 as of 4:04 p.m. New York time

- The Nasdaq 100 fell 2.6 per cent, falling for the third straight day, the longest losing streak since May 5

- The Dow Jones Industrial Average fell 2 per cent, more than any closing loss since Jan. 29

- The MSCI World index fell 1.7 per cent, more than any closing loss since Jan. 29

Currencies

- The Bloomberg Dollar Spot Index rose 0.7 per cent, more than any closing gain since April 30

- The euro slipped 0.6 per cent, more than any closing loss since April 30

- The British pound slipped 0.6 per cent, more than any closing loss since April 30

- The Japanese yen slipped 0.9 per cent, more than any closing loss since March 4

Bonds

- The yield on 10-year Treasuries advanced seven basis points, more than any closing gain since March 12

- Germany’s 10-year yield advanced four basis points, climbing for the sixth straight day, the longest winning streak since Feb. 8

- Britain’s 10-year yield advanced five basis points, more than any closing gain since March 12

Commodities

- West Texas Intermediate crude rose 0.8 per cent, climbing for the fourth straight day, the longest winning streak since April 15

- Gold futures fell 0.9 per cent to US$1,820 an ounce