Jan 20, 2019

Asian Stocks to Advance as Global Rally Builds: Markets Wrap

, Bloomberg News

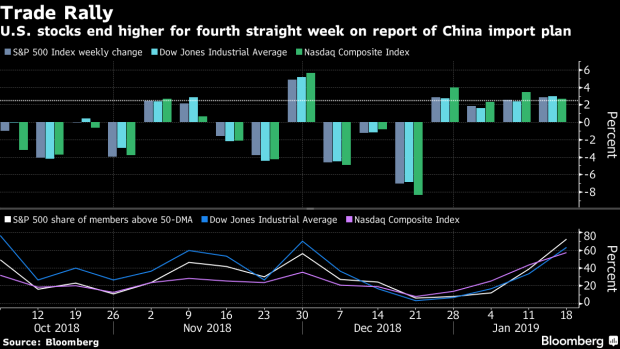

(Bloomberg) -- Asian stocks looked set to kick the week of on positive footing amid optimism steps are being taken toward a U.S.-China trade truce.

Futures on equities in Japan and Hong Kong climbed late Friday after the S&P 500 Index advanced to the highest level since Dec. 6. In the latest sign the two sides are eager for a deal, a report showed China had offered a path to eliminate its trade imbalance with the U.S. by ramping up purchases of goods made in America. Treasury yields on 10-year notes pushed higher and the dollar rose.

In addition to easing of U.S.-China tensions, dovish commentary from the Federal Reserve and efforts in China to support the slowing economy has helped buoy risk assets since their December lows. Next up: a China GDP report on Monday and a continuation of earnings season. American markets will be closed in honor of the Martin Luther King Jr. holiday.

Meantime, the pound was steady. Theresa May briefed her Cabinet on Sunday evening that there was little prospect of cross-party Brexit talks yielding a workable alternative plan to the one that Parliament overwhelmingly rejected last week. Instead she is seeking changes to the Irish backstop section of the deal she’s negotiated with the European Union.

Elsewhere, oil remained above $53 a barrel and commodities extended their recent advance on Friday.

Terminal users can read our Markets Live blog.

These are the main moves in markets:

Stocks

- Futures on Japan’s Nikkei 225 advanced 1.5 percent late Friday in Singapore.

- Hang Seng futures rose 1 percent.

- The S&P 500 Index gained 1.3 percent Friday, to the highest since Dec. 6.

Currencies

- The yen was steady at 109.65 per dollar.

- The offshore yuan held at 6.8024 per dollar.

- The euro bought $1.1365.

- The pound traded at $1.2872.

Bonds

- The yield on 10-year Treasuries rose three basis points to 2.78 percent Friday.

Commodities

- The Bloomberg Commodity Index gained 1.2 percent Friday to a five-week high.

- West Texas Intermediate crude climbed 3.3 percent to $53.80 a barrel.

--With assistance from Nancy Moran.

To contact the reporter on this story: Adam Haigh in Sydney at ahaigh1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.