Dec 2, 2019

Asian Stocks to Drop on Tariff Jitters, U.S. Data: Markets Wrap

, Bloomberg News

(Bloomberg) -- Asian stocks looked set to fall Tuesday on renewed worries over global trade and disappointing U.S. factory data. The yen climbed.

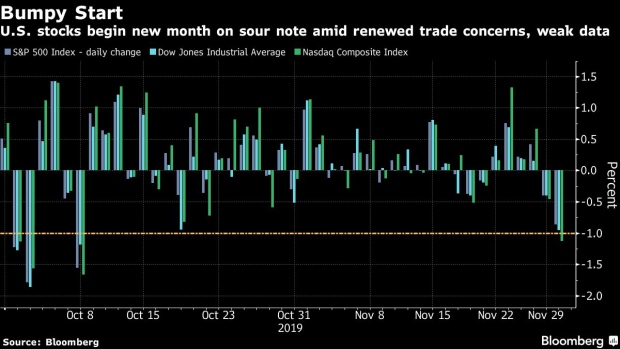

Futures in Japan, Australia and Hong Kong pointed lower. The S&P 500 Index fell the most in almost eight weeks after President Donald Trump reinstated levies on steel and aluminum from Argentina and Brazil and amid concerns the U.S. will slap fresh tariffs on China. The risk-off mood spread to Europe, where shares had the biggest slump in two months. The dollar slid against most major peers. Ten-year Treasury yields closed higher but off their intraday peak.

Trump’s latest tariff imposition and Commerce Secretary Wilbur Ross’s warning that China could face a similar fate overshadowed hope the world’s two-biggest economies were close to signing the first part of a trade deal. Meantime, an unexpected decline in U.S. manufacturing showed the sector lacked momentum in an environment of corporate investment cutbacks, subdued global demand and a still-simmering trade war.

“This much-watched data point certainly doesn’t justify the equity rally in any capacity,” Chris Weston, head of research at Pepperstone Group Ltd. said in a note Tuesday. “The manufacturing data hit the market at a time when sellers were prevalent anyhow, with headlines around trade causing anxiety levels to rise.”

The American manufacturing miss also countered signs of recovery in China and Europe, and could reignite bets on further Federal Reserve easing. Earlier Monday, Trump again called on the Fed to loosen monetary policy.

Traders also monitored the latest on retail after Black Friday hit a record $7.4 billion in U.S. online sales. American shoppers are on track to spend an estimated $9.4 billion on Cyber Monday -- a record -- boosting an already robust holiday shopping season. Yet a gauge of retailers in the S&P 500 dropped on Monday, joining broader market losses.

Elsewhere, oil rose the most in more than a week as traders sifted for fresh signals of whether OPEC and allied crude producers will tighten supplies when they meet later this week.

Here are some key events coming up this week:

- The Reserve Bank of Australia’s monetary policy decision is due Tuesday.

- Saudi Aramco’s initial public offering is scheduled to be priced on Thursday.

- Friday brings the U.S. jobs report, where estimates are for non-farm payrolls to rise by 190,000 in November.

These are the main moves in markets:

Stocks

- Nikkei 225 futures dropped 1.4%.

- Australia S&P/ASX 200 Index futures lost 1.3%.

- Hang Seng Index futures fell 0.6%.

- The S&P 500 slid 0.9%.

Currencies

- The yen rose 0.5% to 108.97 per dollar.

- The offshore yuan lost 0.2% to 7.0433 per dollar.

- The Bloomberg Dollar Spot Index fell 0.3%.

- The euro climbed 0.6% to $1.1080.

Bonds

- The yield on 10-year Treasuries climbed four basis points to 1.82%.

Commodities

- West Texas Intermediate crude rose 1.5% to $55.98 a barrel.

- Gold decreased 0.1% to $1,462.80 an ounce.

--With assistance from Rita Nazareth, Vildana Hajric and Sophie Caronello.

To contact the reporter on this story: Andreea Papuc in Sydney at apapuc1@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.