Dec 17, 2018

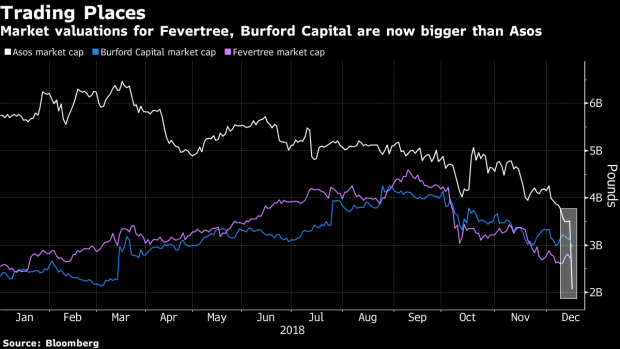

Asos Toppled as AIM's Biggest Company After Cutting Outlook

, Bloomberg News

(Bloomberg) -- In a single swoop, online fashion retailer Asos Plc has lost its place atop Britain’s junior market for growth companies.

A 43 percent intraday plunge on a reduced sales outlook slashed Asos’s market value by about 1.5 billion pounds ($1.9 billion) to 2 billion pounds, meaning its title as the biggest company on London Stock Exchange’s AIM market has been taken by biotechnology firm Hutchison China MediTech Ltd.

“Consumers are reining in spending and investors need to be prepared for volatility when it comes to Asos,” IG Group Holdings Plc chief market analyst Chris Beauchamp said by phone. “Asos could be an interesting long-term opportunity particularly at the current share price, although investors may want to wait for signs of a turnaround before taking action.”

Three other AIM companies also overtook Asos, relegating it to fifth position by market value. Litigation-funding firm Burford Capital Ltd. is the new No. 2, followed by tonic maker Fevertree Drinks Plc and biotech stock Abcam Plc, according to data compiled by Bloomberg.

To contact the reporter on this story: Lisa Pham in London at lpham14@bloomberg.net

To contact the editors responsible for this story: Celeste Perri at cperri@bloomberg.net, Paul Jarvis

©2018 Bloomberg L.P.