Oct 31, 2021

Australia Beats Hong Kong in IPOs for First Time Since 2019

, Bloomberg News

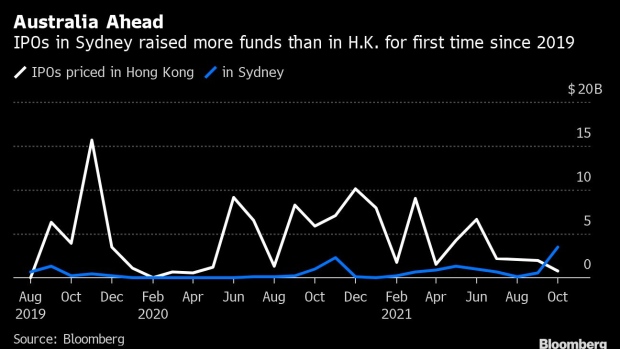

(Bloomberg) -- The market for initial public offerings in Sydney has been on a tear, with the amount of deals priced last month surpassing that in Hong Kong for the first time in over two years.

Twenty companies raised a total of about $3.5 billion in Australia in October, the highest monthly value since November 2014. That compares with $732 million booked in three deals in Hong Kong, the lowest amount for a month since April 2020.

Australia’s strong performance is likely to continue, as the fourth quarter is usually the busiest for IPOs in the country. Several big-ticket deals are already in the pipeline, with infrastructure services provider Ventia Services Group Pt seeking to raise as much as $900 million. Australia’s border reopening this month will also see business and the economy pick up.

READ: Australia Braces to Open Borders and Face Life After Covid Zero

In contrast, in Asia’s traditional financial hub Hong Kong, big first-time offerings have almost entirely vanished since early July, when China widened a regulatory crackdown over industries ranging from tech and property to education. The benchmark Hang Seng Index is one of the world’s worst performers this year and a tech rebound lost steam last week.

Among companies that raised more than $400 million through IPOs in Sydney last month and expected to start trading in November are application software developer Siteminder Ltd. ($470 million) and human resources, health care company APM Human Services International Ltd. ($731 million).

©2021 Bloomberg L.P.