Aug 14, 2019

Australia Fund Aiming to Double in Size Wants 20 New Managers

, Bloomberg News

(Bloomberg) -- Australian pension fund First State Super is on a hiring spree as it seeks to more than double in size to A$200 billion ($136 billion) within the next four years.

The Sydney-based firm’s investment team will grow to more than 100 from 80 by 2022 as it builds out in-house expertise across equities, fixed income, infrastructure and direct lending, Chief Investment Officer Damian Graham said.

“What we’re trying to do is position ourselves so that we have the right set of opportunities,” Graham said in an interview in Sydney. “Capabilities internally are important to be able to execute on the opportunities.”

First State is joining the nation’s largest pension funds in bringing more investment in house as they get directly involved in takeovers and snap up global assets. With Australia’s mandatory retirement savings pool gripped by a wave of consolidation and forecast to almost double in size to A$5.4 trillion in a decade, funds can’t afford to stand still if they want scale.

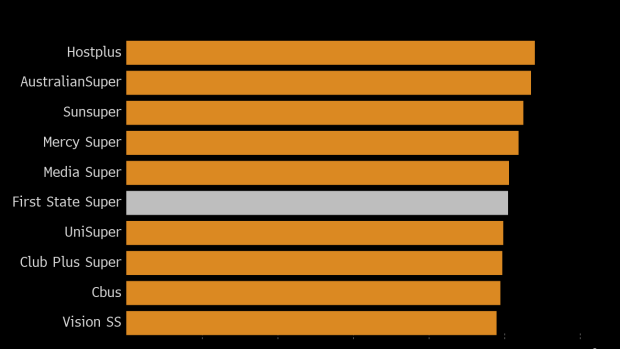

The firm, which currently has A$90 billion of assets, and VicSuper are conducting due diligence on a proposed merger that aims to create a A$120 billion fund next year -- second only in size to AustralianSuper. The ongoing inflow of mandatory retirement contributions plus returns should take it to A$200 billion by 2023, Graham said.

“We need to be building for more,” he said. “If we get to there in four year’s time, obviously we’ll keep going.”

First State is hiring about a dozen people this year as it plans to double the money it manages in house to A$30 billion. About a third of that is expected to be given to new stock strategies in development. The equities team has built a quantitative, factor-based Australian stock strategy, is testing a retirement focused strategy and wants to expand into global stocks.

Read More: Bankers Jump Ship to Pension Funds for Better Hours, Less Stress

The fund will use internal teams and external money managers across all asset classes, though the “blend” will be determined by the fund’s confidence in its own abilities, he said.

The fund is also directly investing in real assets. It is building homes to rent with Lendlease Group in the U.S., owns Bankstown Airport in Sydney’s west, and is developing an industrial precinct near the site of the proposed Western Sydney Airport. About 60% of infrastructure investments are already handled in house.

“We like that style to buy platform opportunities and see multi-year follow-on investment opportunities,” Graham said.

Looking Offshore

It’s also exploring private investments in China, particularly commercial property, through its partners including Warburg Pincus and Nexus Point. Graham cited the “risk of dislocation” in the world’s second-largest economy.

“If you’ve got a forced selling situation, that can create great opportunities,” Graham said. “We’re getting a sense that that’s really starting to bubble up over there.”

While the fund has an interest in emerging Asia, Graham isn’t yet convinced it must open offices offshore given the fund’s strong relationships with local partners.

“There’d be benefits there, there’d be costs there, so it’s just about defining what suits a particular circumstance,” Graham said. “Over time though, as we want to do things increasingly in that hybrid model and increasingly direct, then we will need some local presence to drive that.”

To contact the reporter on this story: Matthew Burgess in Melbourne at mburgess46@bloomberg.net

To contact the editors responsible for this story: Edward Johnson at ejohnson28@bloomberg.net, Andreea Papuc

©2019 Bloomberg L.P.