May 29, 2023

Australia’s Building Approvals Slump to Lowest Level in 11 Years

, Bloomberg News

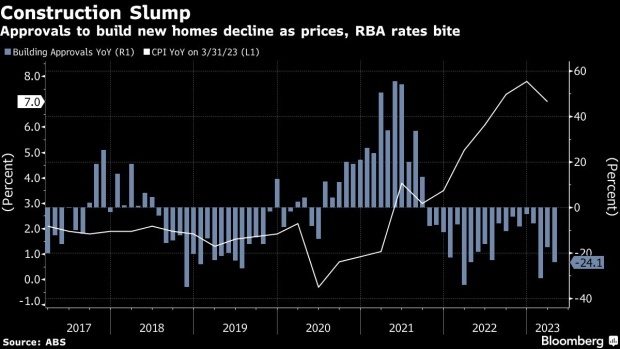

(Bloomberg) -- Australian approvals to build new homes tumbled to the lowest level in 11 years, driven by fewer permits for apartment buildings, suggesting weak residential property investment will continue to drag on the economy.

Total dwelling approvals slid 8.1% in April from a month earlier as permits for apartments plunged 16.5%, Australian Bureau of Statistics data showed Tuesday. While the monthly series can be volatile, the trend has been weak for an extended period, with total approvals falling 24.1% from a year ago.

“Total dwellings approved fell to the lowest level since April 2012,” Daniel Rossi, ABS head of construction statistics, said in a statement. “Private sector house approvals also continued to decline.”

Australia’s residential construction industry is reeling from a combination of shortages of materials and labor, falling property prices and an unwinding of government subsidies that drove demand during the pandemic. High interest rates are also crimping demand and driving up financing costs.

The Reserve Bank is in the midst of its most aggressive tightening cycle in a generation, having hiked by 3.75 percentage points since May 2022 to take the cash rate to 3.85%. RBA Governor Philip Lowe has reiterated the board’s determination to do what is required to bring inflation back to the 2-3% target.

A key risk to that goal is that a housing shortfall risks further fueling rental inflation at a time when the economy is seeing a strong rebound in population growth from immigration.

“There is no ignoring the fact that the mismatch between supply and demand continues to be the driving force pushing capital city rents higher,” said Kaytlin Ezzy, an economist at property consultancy CoreLogic Inc. “In April, national unit listings continue to be around 20% below the levels typically expected this time of year, a shortfall of around 10,000 listings.”

Money market bets imply the RBA’s tightening cycle is all but done though economists at Goldman Sachs Group Inc., Credit Suisse AG and National Australia Bank Ltd. see more to come.

Data next week is likely to show dwelling investment detracted from overall gross domestic product growth in the first three months of the year, and economists expect the weakness to persist in response to higher borrowing costs.

--With assistance from Tomoko Sato.

©2023 Bloomberg L.P.