Jun 6, 2023

Australia’s Economy Cools as Aggressive Rate Hikes Take Toll

, Bloomberg News

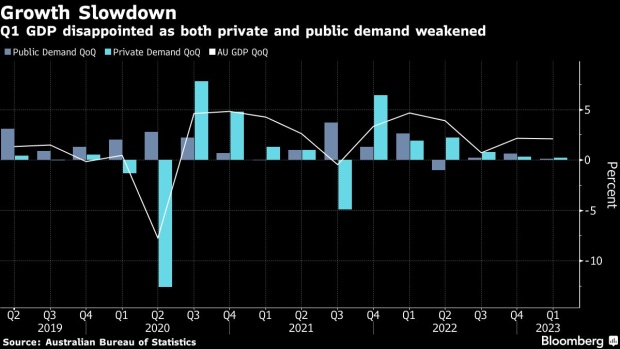

(Bloomberg) -- Australia’s economy slowed more than expected last quarter as aggressive policy tightening weighed on household spending and construction, while accelerating labor costs underlined the nation’s inflation challenge.

The currency edged lower after gross domestic product advanced 0.2% from the prior quarter, the weakest three-month expansion since September 2021 and below a forecast 0.3% gain, data showed Wednesday. From a year earlier, the economy grew 2.3%, slowing from a downwardly revised 2.6%.

The result is unlikely to surprise Reserve Bank policy makers who forecast a substantial economic slowdown over the coming year. But an acceleration in labor costs will add to worries that price pressures are set to be prolonged even after 12 interest-rate increases since May 2022.

Employee compensation accelerated to 2.4% in the first three months of the year — the fastest pace since June 2007 — driven by the public sector and higher than usual end of year bonuses.

Unit labor costs, or the difference between nominal wages and productivity, jumped 7.9% from a year ago, prompting economists at Goldman Sachs Group Inc to raise their forecast peak rate to 4.85% from 4.35% previously.

That came just hours after Governor Philip Lowe highlighted a range of upside risks to the RBA’s inflation outlook, including recent wage outcomes and a rebound in house prices, saying the rate-setting board’s patience was being tested.

“Combined with today’s National Accounts data showing a surprise acceleration in unit labor costs, we now expect the RBA to hike 25-basis-points in July/August/September to a terminal rate of 4.85%,” Goldman’s Andrew Boak said. “We view the risks as skewed to a more elongated tightening cycle.”

Consumer spending growth outpaced the rise in gross disposable income, with the report showing the savings ratio fell to the lowest level in nearly 15 years, Katherine Keenan, ABS head of National Accounts, said in a statement.

Household spending advanced just 0.2% in the first quarter, adding 0.1 percentage point to growth.

“This was driven by higher income tax payable and interest payable on dwellings, and increased spending due to the rising cost of living pressures,” Keenan added.

The GDP data follow back-to-back unexpected RBA hikes that took the cash rate to 4.1%, its highest level since April 2012, threatening the central bank’s goal of a soft landing. Economists see a better than 1-in-3 chance of an Australian recession over the next 12 months as higher borrowing costs begin to crimp domestic consumption.

What Bloomberg Economics Says...

“Households are struggling — and we see no light at the end of the tunnel. We expect sluggish growth to continue through 2023 as tighter monetary policy works its way through the economy. A recession can’t be ruled out, despite the boost from strong population growth”

— James McIntyre, economist.

— To read the full note, click here

Central banks worldwide have been rapidly tightening policy in response to stubbornly strong inflation, even at the expense of slower growth and higher unemployment. The Federal Reserve is under pressure to keep raising rates as US consumer prices remain elevated, although it may skip at the June meeting.

For Australia’s center-left government, the GDP data mean it has to navigate rising consumer prices, higher borrowing costs and slower growth as it enters a second year in office.

“Rising interest rates are clearly biting,” Treasurer Jim Chalmers said after the release. “Households pulled back on discretionary spending to make room for the essentials in their household budget. Squeezing household budgets are weighing on economic growth more broadly.”

Today’s GDP report also showed:

- Dwelling investment fell 1.2%, cutting 0.1 percentage point from GDP

- Machinery and equipment investment surged 6%, adding 0.2 point

- The household savings ratio fell further to 3.7% from 4.4%

--With assistance from Tomoko Sato.

(Adds comments from economists, Treasurer Jim Chalmers)

©2023 Bloomberg L.P.