Mar 28, 2021

Australia’s Resources Riches Have Made Its Economy Covid-Proof

, Bloomberg News

(Bloomberg) --

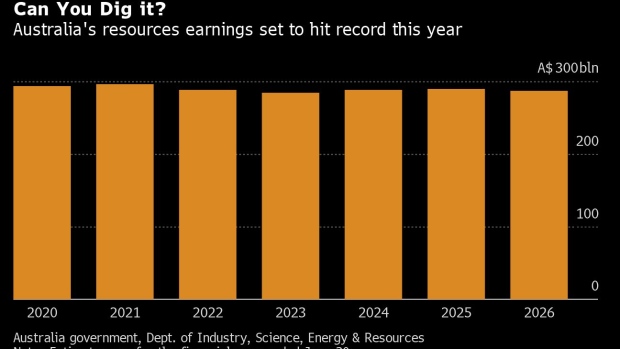

The global economic recovery is set to drive Australia’s resources earnings to an all-time high this financial year, led by number one export iron ore, while rapid growth in the production of battery minerals will see them challenge coal in importance in coming years.

A strong bounce back from the pandemic, especially in China, is forecast to lift Australia’s resources and energy exports to A$296 billion ($225 billion) in the year ending June 30, according to a quarterly report from the government.

Iron ore giants BHP Group, Rio Tinto Group and Fortescue Metals Group Ltd. are enjoying an earnings bonanza after prices surged on the back of strong demand from Chinese steelmakers and supply disruptions in number two producer Brazil. The strength in iron ore, and other key exports such as liquefied natural gas and copper, has helped to insulate the Australian economy from Covid-19, with gross domestic product strengthening by more than 3% in the final two quarters of 2020.

“The outlook for Australia’s resources and energy exports has strengthened since our last report, supported by the global economic recovery and associated government stimulus measures,” the Department of Industry, Science, Energy and Resources, said in a media release. Production constraints elsewhere in the world had seen prices for many commodities gain momentum in the early part of 2021, the department said.

Price gains are likely to moderate, leading to a modest decline in resources earnings in fiscal 2022, although growth in demand for the materials vital to the clean energy transition is seen buoying the industry out to 2026 and beyond. Lithium exports are set to jump more than five-fold over the period which, along with strong copper and nickel output gains, will put the value of those three metals combined at A$28 billion, just short of Australia’s third-largest export earner in that year, metallurgical coal.

China’s import ban on some Australian commodities poses a downside risk to the forecasts, the report said, even though coal and copper producers had successfully diverted sales to other markets. “At present, a high degree of uncertainty exists around the extent to which China’s informal import restrictions will persist through the outlook period,” the report said.

©2021 Bloomberg L.P.