Mar 13, 2023

Australia’s Weak Sentiment Bolsters Case for RBA to Pause Rates

, Bloomberg News

(Bloomberg) -- Australian business confidence slipped into negative territory and household sentiment remained deeply pessimistic, separate surveys showed Tuesday, bolstering the case for the Reserve Bank to pause its tightening cycle.

Business confidence fell 10 points to minus 4 in February, a National Australia Bank Ltd. survey showed, in a result Chief Economist Alan Oster said suggested the “outlook remains clouded.”

RBA Governor Philip Lowe nominated business surveys as one of four reports the rate-setting board will monitor closely ahead of its April 4 meeting. A second key reading is jobs data on Thursday that economists expect will show a powerful rebound with unemployment falling to 3.6%.

The other two are retail sales and monthly inflation.

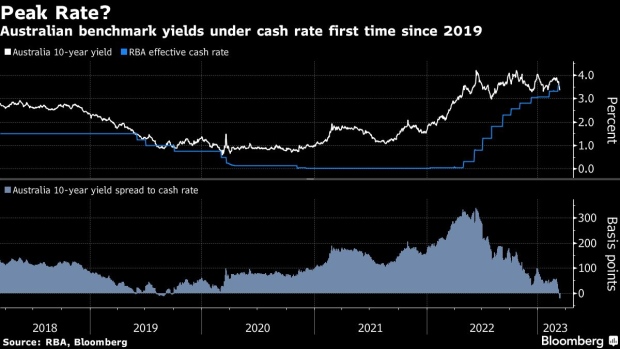

Earlier, a Westpac Banking Corp. survey showed consumer sentiment holding near a 30-year low as households grappled with rising prices and higher borrowing costs. The RBA has raised rates by 3.5 percentage points since May, when they stood at a record-low 0.1%.

Yet Lowe’s reports and borrowers’ worries about the outlook may be swept aside, with money markets having all but erased odds of policy makers raising rates further. The collapse of Silicon Valley Bank has even prompted traders to price some chance of RBA rate cuts in the second-half of this year.

Consumer and business confidence are beginning to converge after an extended split while the RBA delivered it sharpest tightening cycle in 33 years to contain inflation. Firms had remained positive for a period even as rising cost of living pressures and higher mortgage repayments sent consumer confidence tumbling.

Tuesday’s NAB report showed business conditions — measuring hiring, sales and profits — edged down 1 point to 17 in February. The RBA closely monitors conditions as they reflect firms’ current experiences and the result showed “ongoing resilience,” Oster said.

He predicts “a more material slowdown in demand later in the year when the full effect of rate rises has passed through.”

Forward orders edged down 3 points and capacity utilization slipped to 85.2%, the report showed.

“Prices growth does appear to be easing in retail as global supply issues resolve,” Oster said. “However, our survey shows little evidence of easing in services prices for consumers, which remains a key focus for the RBA.”

©2023 Bloomberg L.P.