Oct 30, 2022

Australia Set for Another Close Call on Interest-Rate Decision

, Bloomberg News

(Bloomberg) -- Australia’s central bank faces a tough task in deciding whether to persist with smaller interest-rate increases or U-turning back to outsized hikes to try to gain control of hotter-than-expected inflation.

Financial markets and most economists surveyed by Bloomberg expect the Reserve Bank will deliver a second straight quarter percentage-point rise at Tuesday’s meeting. That would take the cash rate to 2.85%, the highest level since April 2013. But there are still some high-profile dissenters and doubters.

They’re led by Westpac Banking Corp.’s Bill Evans and Barrenjoey Markets Pty Ltd.’s Jo Masters who expect a fifth half-point hike in six meetings to reinforce the RBA’s inflation-fighting credentials. Goldman Sachs Group Inc.’s Andrew Boak sees a quarter-point move but highlights the risk of a bigger one, as does Commonwealth Bank of Australia’s Gareth Aird, who predicts a “line-ball” call.

Governor Philip Lowe has regularly wrong-footed RBA-watchers. He embarked on a tightening cycle in May with a larger than expected quarter-point hike and followed that up with a surprise half-point move in June. Then he broke ranks with global counterparts in October by downshifting to a quarter-point increase.

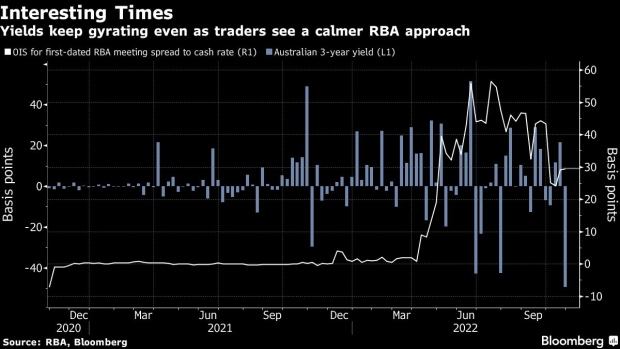

Overnight-indexed swaps imply a 20% chance of an outsized move Tuesday. Australia’s 10-year yield is a full 25 basis points below similar-dated US notes, underscoring investors’ expectations that the RBA will take a softer line than the Federal Reserve.

“I was surprised by the lack of a strong move from markets to price for a larger rate hike after that very strong CPI print,” said Stephen Miller, an investment consultant at GSFM, a unit of Canada’s CI Financial Corp.

“If they fail to respond they risk looking averse to assuming a front line role in the fight against inflation, which is how every central bank needs to be positioning itself to be.”

Australian bonds surged late this month even after the upside inflation surprise, driven by expectations that the global wave of outsized hikes is drawing to a close.

Three-year Aussie yields tumbled almost 50 basis points last week, the biggest drop since 2011. They stood at 3.31% on Monday, a dramatic tumble from the 10-year high of 3.78% touched on Oct. 21.

The RBA’s 2.5 percentage points of hikes over six months have sent house prices tumbling, reversing the wealth effect, while the economy has added just 500 jobs in the past three months, suggesting hiring is stalling.

Yet inflation soared an annual 7.3% in the third quarter, the fastest pace in 32 years, indicating that despite contained wage growth, Australia isn’t that different to other countries struggling to contain prices.

What Bloomberg Economics Says...

“The CPI miss is backward looking, with the bank’s updated projections taking into account a weakening housing market and a stalling labor market that should curb the risk of wages growth accelerating by enough to sustain inflation above the 2-3% target.”

-- James McIntyre, economist

For full note, click here

Two areas still running in the economy’s favor are retail sales, underpinned by households tapping cash built up during the pandemic, and strong exports.

All this will be reflected in the RBA’s quarterly update of economic forecasts released Friday. The central bank estimated in its August update that inflation would peak at just under 8% later this year.

Also playing in favor of smaller RBA increments was Treasurer Jim Chalmers’ fiscal restraint in last week’s budget as he sought to avoid adding to demand.

CBA’s Aird, among a handful of economists to correctly predict the RBA’s October pivot, sees a 40% chance of a half-point hike.

The RBA’s decision comes in the same week as the Fed is expected to raise its benchmark by 75 basis points for the fourth straight meeting.

The median estimate of economists is for the RBA to halt at a cash rate of 3.5% next year. Financial markets are more aggressive, predicting hikes through to mid-2023 and a peak of 3.9%.

Two other points favor sticking with quarter-point moves. The first is that the RBA meets more often than global counterparts. The other was laid out in minutes of the October meeting.

The RBA said that drawing out the tightening cycle would “help to keep public attention focused for a longer period on the board’s resolve to return inflation to target.”

--With assistance from Tomoko Sato.

(Adds Australia-US yield gap in fifth paragraph, updates yields in ninth.)

©2022 Bloomberg L.P.