Florida’s Home Insurance Industry May Be Worse Than Anyone Realizes

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Latest Videos

The information you requested is not available at this time, please check back again soon.

A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Whirlpool Corp., the owner of the Maytag and Amana appliance brands, is cutting about 1,000 salaried positions worldwide to reduce costs as slow US home sales limit demand.

Chicago Bears officials alongside Mayor Brandon Johnson unveiled plans for a $4.7 billion project to build a publicly owned, enclosed stadium and enhanced lakefront area.

Eleven hotels earned the top three-key distinction, in a list that focused on major markets rather than being truly comprehensive.

Blackstone Inc. and KKR & Co. mortgage real estate investment trusts are grappling with deteriorating office loans as higher interest rates and weak demand drive down property values.

May 19, 2019

, Bloomberg News

(Bloomberg) -- Australia’s dollar rose after the conservative Liberal-National coalition retained power in an election over the weekend.

The currency advanced as much as 1% after Prime Minister Scott Morrison’s center-right government defied opinion polls and hung on to power. After paring initial gains, the Aussie bought 69.02 U.S. cents, up 0.5% as of 7:52 a.m. in Sydney.

Despite trailing in most opinion polls, Morrison waged a relentless attack on the Labor Party’s progressive agenda to take action on climate change and strip tax perks from wealthy Australians. At the same time, the government ran on its record of economic management, across-the-board tax cuts and a return to a budget surplus.

As Labor’s tax proposals are off the table, giving some relief to the housing market, and with the incumbent government being viewed as stronger economic managers, business sentiment is expected to improve, said Andrew Ticehurst, Sydney-based rate strategist at Nomura Holdings Inc. It’s a net positive for Australian assets, he wrote in note to clients dated May 19.

“With a surprise election result over the weekend, we immediately square up our tactical short in the Australian dollar and expect short-end rates to rise,” Ticehurst said. The short position was opened at 69.55 cents on May 14, he said.

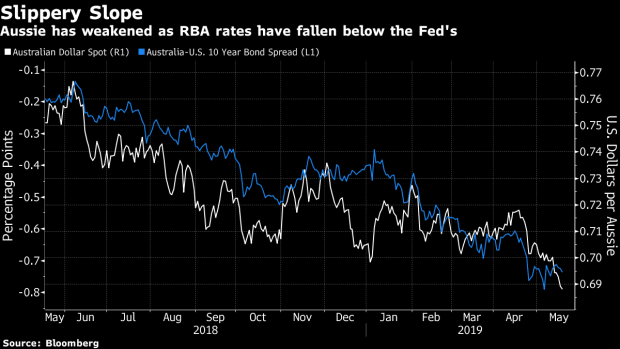

Australia’s dollar has fallen more than 2% against the greenback this year amid slowing economic growth and an escalation of the U.S.-China trade war. The likelihood of the Reserve Bank of Australia cutting borrowing costs in June to stimulate the economy has risen to more than 70 percent, according to overnight index swaps.

A speech by Reserve Bank Governor Philip Lowe on Tuesday titled ‘The Economic Outlook and Monetary Policy’ may be pivotal given Lowe has previously used speeches to provide monetary policy guidance.

National Australia Bank Ltd. recently brought forward its RBA rate-cut call to June from July, and sees potential for additional easing by early 2020. JPMorgan Chase & Co. senior strategist Sally Auld expects two rate cuts this year and said the RBA has enough data to justify a move next month.

--With assistance from Michael G. Wilson.

To contact the reporters on this story: Matthew Burgess in Melbourne at mburgess46@bloomberg.net;Ruth Carson in Singapore at rliew6@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, ;Edward Johnson at ejohnson28@bloomberg.net, Andrew Davis, Adam Haigh

©2019 Bloomberg L.P.