Jun 12, 2019

Australian Employment Jumps as Labor Force Swells to a Record

, Bloomberg News

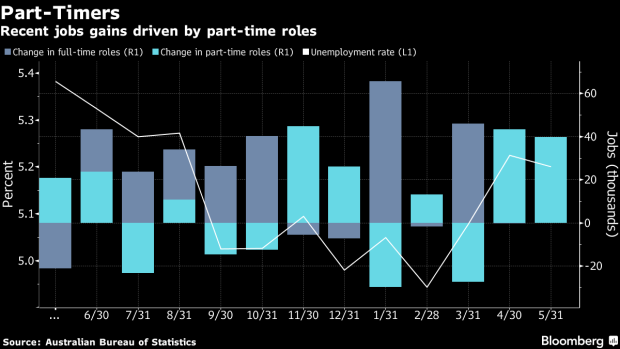

(Bloomberg) -- Australian employment rose more than expected in May as the participation rate rose to a record, driven predominantly by part-time jobs.

Key Insights:

- The May jobs report could have been impacted by the general election, which returned the center-right government in a shock result, as temporary staff were hired to help with the ballot

- Australia’s central bank last week resumed interest-rate cuts -- after an almost three-year hiatus -- as it bids to drive the jobless rate down toward 4.5%, the new estimate of full employment. At that level, policy makers expect the economy to generate faster inflation.

- In lowering the full employment estimate, Reserve Bank Governor Philip Lowe is following in the footsteps of other developed-world counterparts, who’ve had to wait for unemployment to fall to very low levels to spur wage growth

- Pushing Australia’s jobless rate down to 4.5% is likely to prove an uphill battle. The nation’s debt-laden households have hunkered down and cut spending as they grapple with stagnant wages and watch falling house prices erode their wealth

- Australia’s labor market has held up well even as the economy slowed sharply. One explanation for the resilience is that much of the hiring is coming from government-related programs that are impervious to prevailing economic conditions

Market Reaction

- The Aussie dollar fell to 69.23 U.S. cents at 11:51 a.m. in Sydney from 69.27 pre-data

To contact the reporter on this story: Michael Heath in Sydney at mheath1@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Chris Bourke, Victoria Batchelor

©2019 Bloomberg L.P.