Jul 14, 2020

Australian Investors Brace for Biggest Dividend Cuts in a Decade

, Bloomberg News

(Bloomberg) -- Australia’s largest companies are expected to slash dividend payouts over the August reporting season by the most since the global financial crisis as the coronavirus pandemic eroded corporate balance sheets.

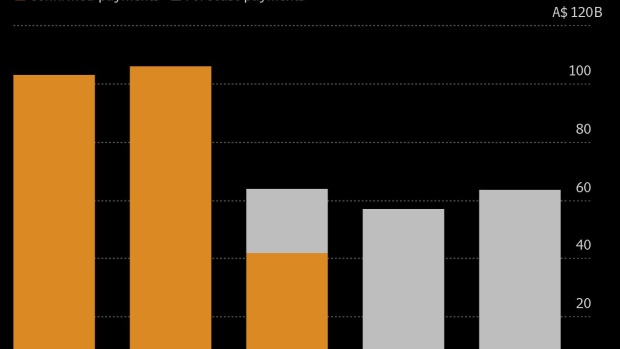

Payments from firms on the S&P/ASX 200 index may plunge as much as 40% in 2020, before declining another 11% in 2021, according to data compiled by Bloomberg. The pace of cuts and cancellations seen earlier this year is set to intensify as Covid-19 lockdowns, social restrictions and travel curbs squeeze company profits.

“The upcoming earnings season will be one of the most interesting reporting periods in the past decade,” said Craig James, chief economist at Commonwealth Bank of Australia’s securities unit. “Analysts and investors expect a similar dropoff in dividend payments to that of the global financial crisis.”

A third of S&P/ASX 100 stocks have reduced, deferred, suspended or canceled dividends since the February reporting season, according to Macquarie Group Ltd.

While just over half of the index maintained payouts, “we expect this number to fall for the June half, which covers the peak of the shutdowns,” the analysts wrote in a July 8 note. “There will be less share price pressure on stocks reducing dividends when most companies are doing the same.”

Australia’s banks, widely held by retail investors for their usually steady stream of payouts, are forecast to see the largest dividend decline in 2020, according to Bloomberg data.

National Australia Bank Ltd. in April sliced its shareholder payment by two-thirds to 30 Australian cents, its lowest since 1993. Australia & New Zealand Banking Group Ltd. deferred its interim payout that same month, while Westpac Banking Corp. followed suit in May.

Morgan Stanley expects the big-four banks to issue final dividends, though there’s a “meaningful chance” they could defer amid uncertainty around capital ratios, analysts led by Richard Wiles wrote in a July 2 note. The nation’s prudential regulator earlier this year urged lenders to trim payouts and executive bonuses in an effort to preserve capital.

Australia’s second-most populous state, Victoria, has been forced to implement stricter lockdown rules for another six weeks to try and curb a surge in infections. The restrictions threaten to deepen and extend Australia’s first recession in almost 30 years, which may prompt some firms to retain capital and hold back on returning funds to shareholders.

Still, iron ore producers like Fortescue Metals Group Ltd., BHP Group Ltd. and Rio Tinto Ltd. could see dividends surprise on the upside given strong pricing and shipments, UBS Group AG analysts led by Glyn Lawcock wrote in a July 9 note. Fortescue is projected to see the largest payout increase over 2020 out of all stocks on Australia’s benchmark index, Bloomberg data shows.

Citigroup Inc. analysts are more positive on banks and resources going into earnings season compared with other sectors.

“We see overall earnings estimates as fair” across the Australian market, analysts led by Liz Dinh wrote in a July 8 note. “However, dividend downside still exists near-term.”

©2020 Bloomberg L.P.