Jul 14, 2020

Axon Says It’s a Software Firm, But Its Tasers Still Dominate the News

, Bloomberg News

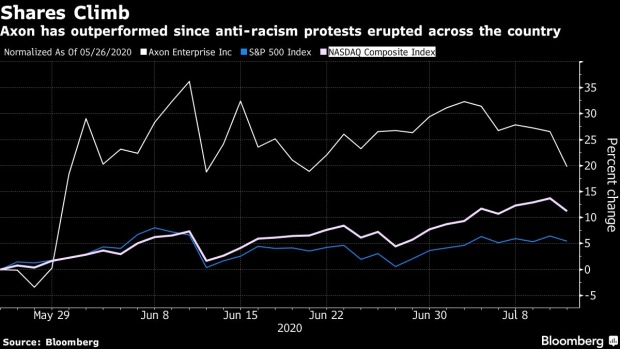

(Bloomberg) -- Shares of stun-gun maker Axon Enterprise Inc. saw a meteoric rise as protests and outrage against racism and police brutality gripped the U.S. in late May, but the company is banking on a future focused on software, not gear.

The company formerly known as Taser International Inc. has risen 19% since May 26, the day after Minneapolis police killed George Floyd, as investors bet on increased demand for stun guns, body cameras and software used by law enforcement. That’s more than three times the return of the S&P 500 Index over the time. Axon’s market value swelled to more than $6 billion and a record share price heralded a secondary offering.

Axon’s stock “often works” after incidents that raise questions about police use of force and oversight on law enforcement, Oppenheimer & Co. analyst Andrew Uerkwitz said in a phone interview. “The thought process behind it is this is a renewed call for accountability.”

The gains come even as Axon emphasizes that it’s a software firm more than a device maker. Tasers and Taser-related equipment accounted for a little over half of the company’s $531 million in revenue last year. Body cameras, sensors and software meant to store, manage, analyze and share evidence made up the rest. But their digital offerings are growing faster and Axon’s long-term plan is to build the segment to 75% to 80% of its business.

Earlier this year, the Scottsdale, Arizona-based company touted arrangements with the federal government for products including body cameras, Tasers and a digital evidence management system. It has also described opportunities in the corrections system.

“We’re an enterprise software company that also happens to sell devices,” Chief Financial Officer Jawad Ahsan said at a recent conference hosted by William Blair.

The pivot would theoretically improve Axon’s growth profile given its saturation in the U.S. law-enforcement market. The company has estimated in the past that around two-thirds of U.S. police officers carry Tasers. But there are concerns over how quickly Axon can make the switch and whether potential gains are already reflected in the valuation, which has a forward price-to-sales ratio of 8.5, not far from levels seen for stocks in the S&P Supercomposite Software Index.

The shift in focus from devices to software had been brewing for some time, according to analysts, but the company made it explicit with its name change in 2017. Prior to that, the Axon name referred to a business segment that included body cameras and cloud products.

“If they’re transforming themselves into a software company, then fine, maybe they do deserve a software multiple,” Uerkwitz said. “But our argument is that it will take a lot of time before that happens.”

Oppenheimer is one of five banks with a hold-equivalent rating on the shares, compared to eight who recommend buying. The stock hasn’t had a sell rating since early 2015, according to data compiled by Bloomberg.

“You have a company that has created a really compelling ecosystem of products,” analyst Scott Berg of Needham & Co. said. He has a buy rating. “This ecosystem will drive sales of its higher margin software products over the next couple of years.”

©2020 Bloomberg L.P.