Apr 21, 2020

Bad News Just Won’t Stop Coming for the Pound

, Bloomberg News

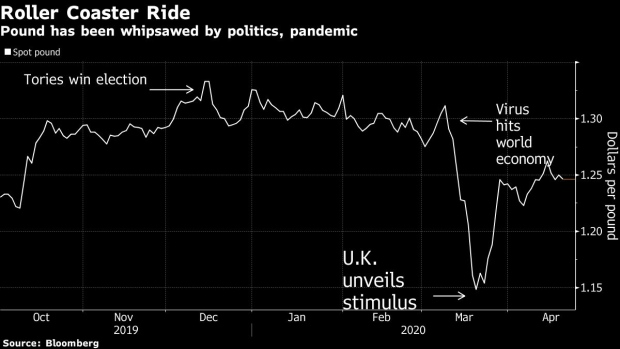

(Bloomberg) -- Still sore from the worst first-quarter drubbing since 2013, the pound now faces further gloom in the form of a familiar menace -- Brexit.

Sterling may be in for more turbulence as Britain and the European Union resume talks over their future trading relationship -- a process already troubled by the U.K.’s refusal to budge on an end-2020 deadline despite the coronavirus crisis.

While some foreign-exchange strategists are betting the pandemic will support the currency by underlining the benefits of a split from the EU, pound pessimism is increasing on fears the final divorce terms will be messy. Analysts at Rabobank, Mizuho Bank Ltd. and Royal Bank of Canada see the U.K. currency extending losses in the coming months amid heightened Brexit uncertainty.

Investors fear that a failure to get a trade deal will add to the troubles of the U.K. economy, which is already exposed to severe damage from the pandemic. As Britain’s refusal to extending the deadline persists, officials say they have made little progress -- only identifying the major areas of disagreement so far.

“Up until now, the foreign-exchange world has largely been dollar-driven” amid the virus outbreak, said Ned Rumpeltin, European head of currency strategy at Toronto-Dominion Bank. “The return of Brexit risks could become a differentiator for sterling -- beyond the direct impact of the virus.”

The U.K. currency has already dropped about 6% against the dollar this year to around $1.2460, and around 3% versus the euro to 87.20 pence. Its 6.3% loss against the greenback during the January-March period was the biggest first-quarter loss since 2013.

From Bad to Worse

Rabobank expects sterling to fall over 4% in the next three months to $1.19, but sees it rebounding toward $1.26 by year-end if a deal is reached, according to head of currency strategy Jane Foley. The pound may drop below $1.20 before the end-June time limit for requesting a Brexit-deadline delay, according to Neil Jones, head of foreign-exchange sales to financial institutions at Mizuho Bank.

Royal Bank of Canada’s Adam Cole sees it falling about 3% to 90 pence per euro by mid-year and to 92 pence by year-end. Option prices show traders are seeking refuge against a drop in the pound against the dollar over the week ahead.

Brexit sent the pound on a roller-coaster ride last year too -- it fell on fears of a no-deal outcome, before rallying in late 2019 as Prime Minister Boris Johnson’s decisive election victory ended a domestic political deadlock.

Yet those moves have paled in comparison with this year’s swings. Sterling plunged to its lowest level against the dollar in over three decades in March as the shocks caused by the coronavirus rippled through global markets.

Betting on a Deal

Not everyone is that pessimistic on the pound.

Standard Bank sees sterling strengthening to 80 pence per euro -- a level not reached since the 2016 vote to leave the EU -- or beyond as the growth shock from the virus forces the EU to reach a deal with Britain to avoid further chaos.

“I don’t think in this economic environment there are many countries that will be really tolerant of trade barriers,” said Stephen Gallo, European head of FX strategy at the Bank of Montreal.

Yet if the two sides still fail to reach a deal, the U.K. would default to trading on terms set by the World Trade Organization -- meaning a return of tariffs and quotas where there are none today.

“The government is determined not to extend the transition period beyond December,” said Kenneth Broux, a strategist at Societe Generale SA in London. “I can’t see how that can be positive for the pound (and euro) against the dollar.”

©2020 Bloomberg L.P.