Jan 22, 2020

Bank Indonesia Seen on Hold as Currency Rallies: Decision Guide

, Bloomberg News

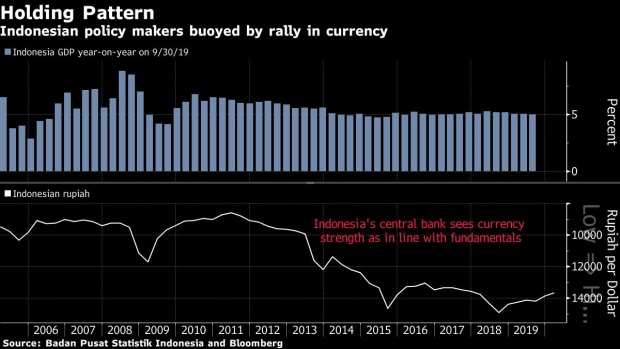

(Bloomberg) -- Indonesia’s central bank is set to leave its benchmark interest rate unchanged Thursday, while keeping an easing bias to support growth in Southeast Asia’s largest economy.

A spike in risk appetite following last week’s U.S.-China trade deal has driven inflows into emerging markets, improving the outlook after last year’s turmoil. Malaysia became the latest developing nation to lower interest rates this year, with a surprise cut Wednesday.

Of the 34 economists surveyed by Bloomberg, 29 predict Bank Indonesia will leave its key interest rate unchanged at 5% Thursday, with the others expecting a 25 basis-point cut. The central bank reduced rates four times last year, and a rally in the currency since the beginning of January enables policy makers to stick to a gradual easing cycle.“The policy messaging is likely to signal a continued accommodative stance against a backdrop of sluggish growth and contained inflation,” said Krystal Tan, an economist at Australia & New Zealand Banking Group Ltd. in Singapore. But there’s “no urgency for a rate cut this week,” given the drop in bond yields and improved liquidity, she said.

Here’s what to look out for in Thursday’s policy decision:

Growth Outlook

Indonesia’s economy has been growing at about 5% for several years, disappointing President Joko Widodo, who had aspirations to see it reach 7%. The government is projecting growth will pick up to 5.3% in 2020 from an estimated 5.1% last year.Bank Indonesia will maintain an accommodative monetary policy stance to support growth, Governor Perry Warjiyo said Wednesday. The bank cut rates by 100 basis points last year and eased macroprudential rules to spur lending in the economy.

A subdued inflation environment provides room for further easing. Consumer prices rose 2.7% in December from a year ago, the slowest pace of growth since March. Bank Indonesia sees inflation moderating even further in the year ahead and has lowered its target band to 2%-4% from 2.5%-4.5% last year.

Rupiah Rally

The rupiah has gained about 2.5% against the dollar in the past month, pushing the currency close to a two-year high, as foreign investors pile into government bonds. The proportion of bonds held by foreigners has risen to above 39%, from about 37% at the same time last year.

While the currency’s gains will help keep inflation at bay, Widodo has raised concerns about how a sharp rupiah appreciation could affect exports.

Satria Sambijantoro, an economist at PT Bahama Sekuritas in Jakarta, said the president’s warnings are unlikely to prompt action from the central bank.

“We believe BI will opt to hold rates and allow the rupiah to strengthen further, rather than cut rates and weaken the currency,” he said.

Trade Worries

The current-account deficit remains a concern for Indonesian policy makers, even though the trade deficit improved dramatically to $3.2 billion last year from $8.6 billion in 2018.

The trade outlook should also improve going forward after the U.S. and China inked a deal that should de-escalate tensions between the world’s two biggest economies.

--With assistance from Tomoko Sato.

To contact the reporter on this story: Karlis Salna in Jakarta at ksalna@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Michael S. Arnold

©2020 Bloomberg L.P.