Jan 22, 2020

Bank of Canada opens door to rate cut on persistent slowdown

, Bloomberg News

Bank of Canada holds key rate at 1.75%

Stephen Poloz, one of the few central bankers to resist the global push toward easier monetary policy last year, said the door is open for the Bank of Canada to cut interest rates if the current economic slowdown persists.

The governor, speaking to reporters after a rate decision Wednesday that left the key interest rate unchanged at 1.75 per cent, said growing slack in the economy threatens to dampen inflation pressures. The central bank chose not to cut, however, because policy makers didn’t want to fuel household debt levels that remain a vulnerability to the economy.

“I’m not saying that the door is not open to an interest rate cut, obviously it is, it is open,” Poloz said when pressed on the issue, adding borrowing costs remain “appropriate” for the time being.

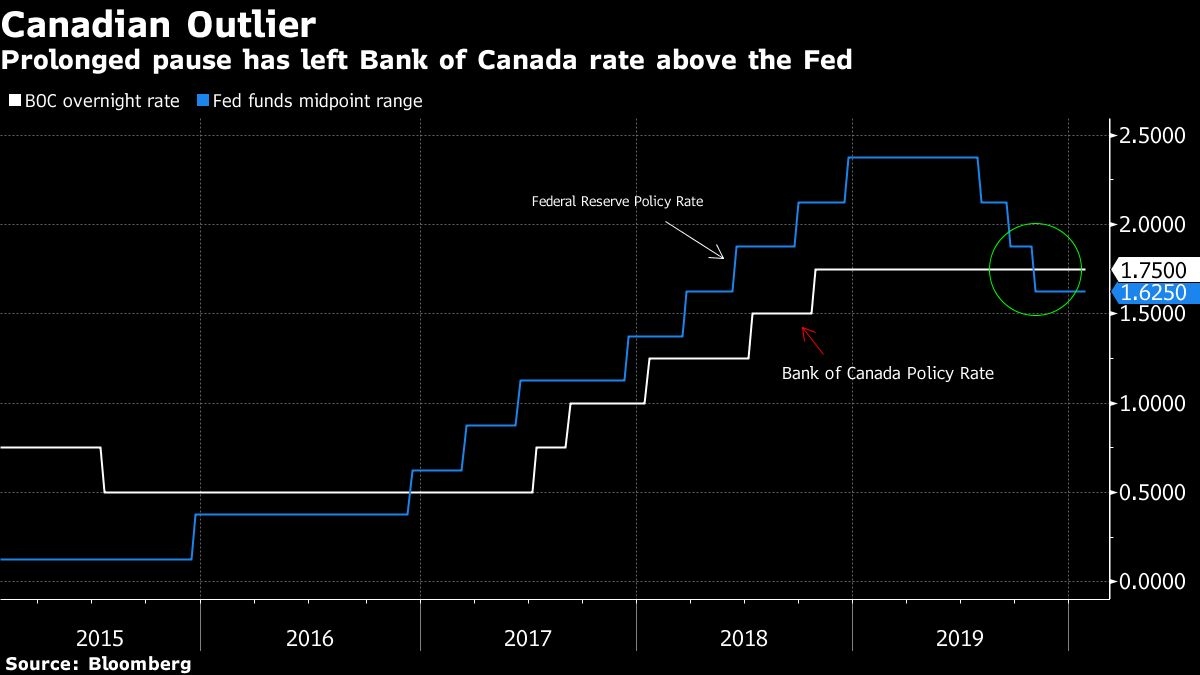

The more negative outlook is a departure from recent communications in which officials sought to accentuate the positives of an economy that had been running near capacity and was deemed resilient in the face of global uncertainty. Wednesday’s decision still leaves the Bank of Canada with the highest policy rate among major advanced economies, but the downturn in domestic economic data since the end of last year has clearly spooked policy makers.

Canada’s currency sold off after the decision, depreciating as much as 0.6 per cent to $1.3146 against its U.S. counterpart at 12:33 p.m. Toronto time. Two-year government bond yields dropped 7 basis points to 1.58 per cent. Investors ramped up bets for rate cuts over the next year, with a move fully priced in over the next 12 months. On Tuesday, markets were pricing in a 50 per cent chance.

Heightened Concern

At its decision Wednesday, which kept rates steady for a 10th straight decision, the Bank of Canada expressed heightened concern about an economy that may have stalled in the fourth quarter. Policy makers revised near-term growth projections and expressed concern global weakness may be spreading to households, affecting domestic spending more than thought. They also seem to be entertaining the idea that underlying factors may be behind the slowdown, rather than temporary drivers.

It’s a change in tone that reflects a shift in growth risks in recent months from global to domestic. Three months ago, the central bank was highlighting the nation’s resiliency to elevated international risks. Snce then domestic economic concerns have come to the forefront.

“In determining the future path for the Bank’s policy interest rate, Governing Council will be watching closely to see if the recent slowdown in growth is more persistent than forecast,” policy makers said in the rate statement. “In assessing incoming data, the Bank will be paying particular attention to developments in consumer spending, the housing market, and business investment.”

The near-term slowdown coupled with a slight upward revision to potential growth prompted the central bank to increase its estimate for the amount of slack in the economy -- from about 0.25% of output in the third quarter to about 0.75 per cent. The bank also projected the economy will be in a state of excess capacity through the end of 2021. That build up in slack -- which bolsters the case for a rate cut -- is being weighed against the possibility that lower interest rates will fuel financial vulnerabilities, Poloz said at the press conference.

All things considered, “it was Governing Council’s view that the balance of risks does not warrant lower interest rates at this time,” Poloz said. “Clearly, this balance can change over time as the data evolve.”

The bank has been here before. In October, officials acknowledged they considered an “insurance” rate cut to counter growing risks associated with global trade tensions, ultimately deciding against it. Poloz indicated the motives for a future move would now be different.

‘Meaningful Shortfall’

If the bank cuts in the future, “it would not be a cut against a hypothetical or a possibility” rather it would mean that the forecast was showing a “meaningful shortfall on our inflation target,” he said.

Even while cutting near-term forecasts, long-term estimates for growth were mostly unchanged from October, with a slightly lower growth forecast in 2020 of 1.6 per cent, but 2021 faster than previously forecast at two per cent.

This suggests the base case scenario at the bank remains that the slowdown that began in the second half of last year will be temporary. The Bank of Canada anticipates that over the next two years household spending will pick up, helped in part by a recent tax cut, as will exports and business investment. It also anticipates inflation will stay around the target over the projection horizon.

--With assistance from Shelly Hagan.WEIGH IN