Sep 1, 2022

Bank of Canada gains traction with public on taming inflation

, Bloomberg News

Canadians more confident on Bank of Canada inflation fight

The Bank of Canada is making some progress in its bid to convince the public it’s serious about curtailing price pressures, a new poll shows.

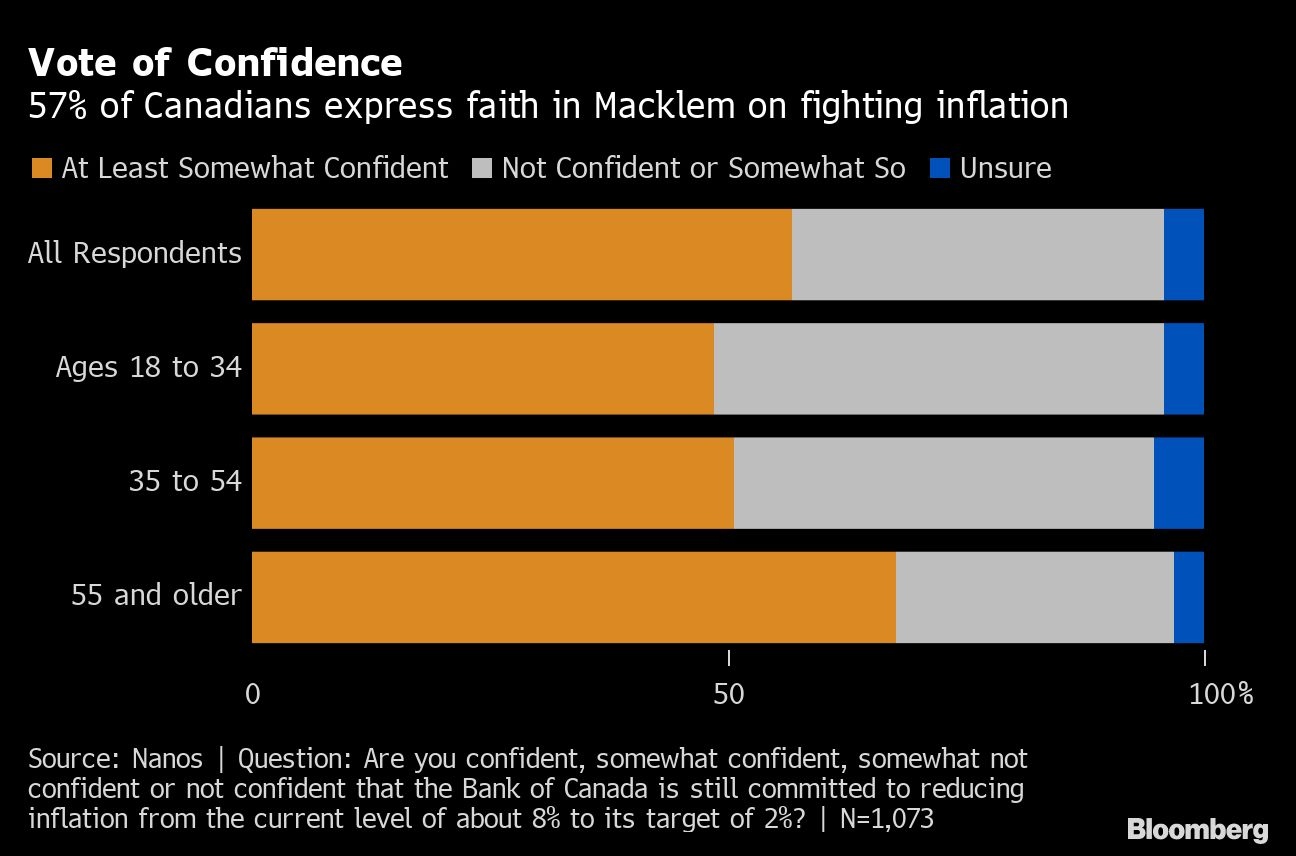

The share of Canadians who expressed some confidence that the central bank remains committed to its 2 per cent inflation target jumped to 57 per cent, according to a Nanos Research Group survey conducted for Bloomberg News. That’s up from 49 per cent in May.

The pick-up in confidence is a welcome development for policy makers led by Governor Tiff Macklem. The Bank of Canada is in the middle of one of its most aggressive interest-rate hiking cycles ever to quell inflation that has hit four-decade highs and is hovering at around 8 per cent.

The accelerated hikes are in large part a confidence-building exercise to convince Canadians that officials remain focused on cooling price pressures and bringing inflation back down to the central bank’s target.

Expected inflation is a major determinant of actual inflation, since businesses increase prices and workers seek pay raises in part on what they anticipate prices will look like in future. That’s why policy makers have become very concerned about the self-fulfilling dynamics of persistently high inflation.

Still, the Nanos poll shows there is still plenty of work to do to ease worries about inflation. Asked what they think annual inflation will be in 12 months, more than 80 per cent of respondents said it would be above 5 per cent. The median estimate was 8 per cent.

The central bank has already raised its benchmark overnight lending rate to 2.5 per cent from 0.25 per cent in early March. Economists expect it will jump to 3.25 per cent at a policy decision next week and to 3.75 per cent by the end of the year. Rates commercial banks give to their prime customers are typically just over 2 percentage points above the Bank of Canada benchmark.

Nanos found 19 per cent of respondents were confident the Bank of Canada was committed to hitting its inflation target, while 38 per cent said they were somewhat confident. About 20 per cent of Canadians said they weren’t confident, while another 19 per cent said they were somewhat not confident. The poll is a hybrid telephone and online survey of 1,073 Canadians, with a margin of error of 3 percentage points, taken between Aug. 27 and Aug. 29.

The Bank of Canada’s mandate requires it to keep inflation within its 1 per cent to 3 per cent control range as much as possible. Operationally, that has meant aiming for a 2 per cent target. Annual inflation has exceeded the upper band of that range for 16 straight months.