Fancy Apartment Rentals for Paris Olympics See Poor Demand and Price Cuts

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

The kingdom must overcome a conservative image and concern about human rights. Visit the desert oasis town of AlUla to understand the challenge.

Jury selection was completed Friday for Donald Trump’s first criminal trial, setting the stage for opening arguments Monday in a New York case accusing the former president of falsifying business records to conceal a sex scandal before the 2016 election.

Higher-than-expected interest rates amid persistent inflation are perceived as the biggest threat to financial stability among market participants and observers, according to the Federal Reserve.

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

Nov 24, 2021

, Bloomberg News

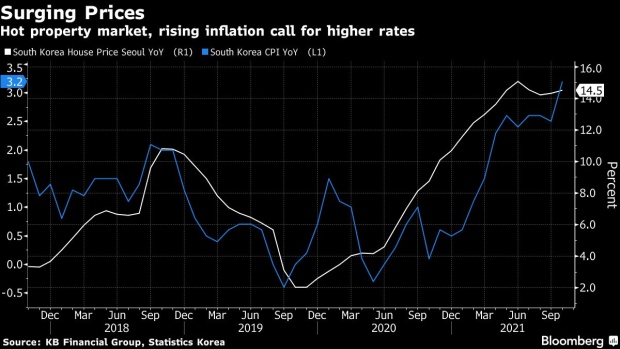

(Bloomberg) -- The Bank of Korea raised interest rates for the second time since August as it tries to avert asset bubbles and prevent inflation from escalating further.

The central bank’s decision Thursday to lift the policy rate by 25 basis points to 1% was expected by all 19 analysts surveyed by Bloomberg. The BOK will shortly release updated forecasts for economic growth and inflation.

The BOK initiated its tightening cycle in August with a focus on reining in financial imbalances, but inflation has since become an increasing concern. Central banks worldwide are grappling with price pressures that threaten to destabilize their economies’ recovery from the pandemic.

New Zealand on Wednesday signaled aggressive tightening ahead after hiking for the second time in two months, while surging U.S. prices are pressuring the Federal Reserve to pivot more quickly to tightening.

At today’s meeting, “market participants may seek potential signs of a third hike timing, which could be either January 2022 or February 2022, in our view,” Citigroup economists led by Kim Jinwook wrote ahead of the decision. “We assign our probabilities on the timing of a third rate hike at 60% for February 2022 and 40% for January 2022.”

Unlike some central banks, the BOK doesn’t have official guidance for its rate trajectory. Instead, the number of dissenters, the board’s outlook and Governor Lee Ju-yeol’s comments are scrutinized for clues.

Swaps markets are pricing in the key rate climbing to around 1.75% in the next 12 months, a steeper rise than the median estimate of economists for the benchmark to reach 1.25% by the end of 2022.

Accelerating inflation and property price gains that show little sign of abating support the case for higher rates. The BOK in August forecast inflation at 2.1% this year and 1.5% in 2022. Significant upward revisions on Thursday could mean further policy tightening ahead.

Adding to uncertainty is Korea’s virus situation: the number of daily cases reached a new record this month as the government loosened restrictions. In addition, while exports have so far benefited from a pandemic-era boom in tech demand, a normalization of that trend could see trade become less of a support to growth.

©2021 Bloomberg L.P.