Sep 20, 2022

Bank of Mongolia Hikes Rates to Tame Prices, Halt FX Outflows

, Bloomberg News

(Bloomberg) -- The central bank of Mongolia hiked interest rates to the highest in five years to try and control rising prices and halt currency outflows.

The main policy rate was raised to 12% from 10%, the Bank of Mongolia said in a statement Tuesday. That was the highest since 2017 and comes as inflation recently hit the highest since 2012, with rising prices prompting protests in the capital earlier this year.

“An increase in the policy interest rate contributes to bringing inflation back to the target level,” the bank said in the statement after the decision. Inflation should moderate following the rate increase, central bank Governor Lkhagvasuren Byadran said as he announced the increase.

Mongolia’s economy has struggled this year due to a weak mining sector and rising inflation which has hit domestic spending. Prices were already increasing quickly even before Russia’s invasion of Ukraine pushed global commodity prices higher, and the sanctions on Moscow since then have disrupted Mongolia’s fuel supply.

“Despite some easing of border restrictions, the negative impact on the mining and transport sectors continues,” the central bank said, referring to China’s Covid Zero controls which have stopped some goods from crossing the border. China is Mongolia’s main trading partner and took 85% of all exports in the first eight months of this year. Restrictions have been eased recently and the newly-built railway should also make it cheaper to transport coal to China.

The economy grew 1.9% y/y in the first half of the year, with sectors such as agriculture and services accelerating growth past 2019’s pre-pandemic levels, while household consumption grew for three consecutive quarters, according to the statement.

Imported goods contributed to about half of the 14.4% growth in the consumer price index in August, according to a September report, with fuel prices in August up 13.2% from a year earlier.

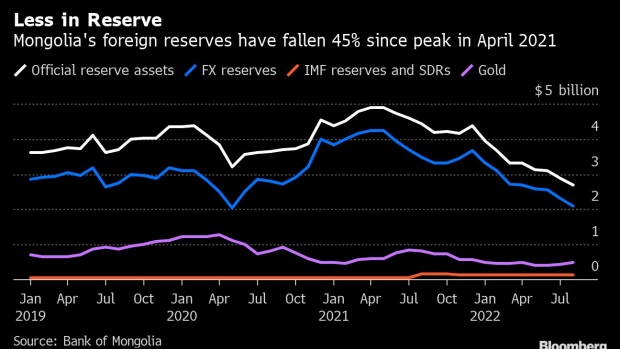

Despite the growing economy, capital outflows are becoming a problem for the government, with the currency losing almost 13% of its value against the dollar this year as the Federal Reserve looks to continue hiking rates. That has put pressure on the central bank’s reserves, which were almost 40% lower in August compared with a year earlier. That’s been driven by both a drop in the value of foreign currency reserves and sales of gold, with volume of gold in the reserves down 38% in a year. Gold exports rose 75% in the first eight months of this year to almost $600 million.

©2022 Bloomberg L.P.