Mar 27, 2023

Banking Crisis Raises Concerns About Hidden Leverage in the System

, Bloomberg News

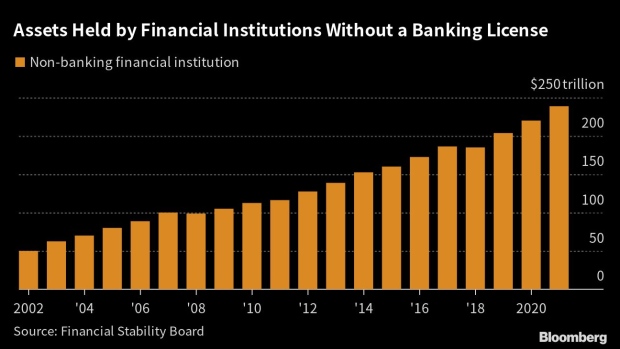

(Bloomberg) -- As traders rush to identify where the next bout of volatility will come from, some watchdogs think the answer may be buried in the huge pile of hidden leverage that’s been quietly built over the past decade.

More than a dozen regulators, bankers, asset managers and former central bank officials interviewed by Bloomberg News say shadow debt and its links to lenders are becoming a major cause for concern as rising interest rates send tremors through financial markets. Federal Deposit Insurance Corp. Chairman Martin Gruenberg and BlackRock Inc. Chairman Larry Fink have called for more scrutiny in recent public comments.

The concern is that private equity firms and others were allowed to load up on cheap loans as banking regulations tightened after the global financial crisis — without enough oversight into how the debt could be interconnected. Though each loan may be small, they have often been layered up in such a way that investors and borrowers could suffer if banks or other credit providers suddenly pull back.

“A slight downturn and an increase in interest rates will make some corporates default,” said Ludovic Phalippou, a professor of financial economics at Oxford University. “This puts their private debt providers in trouble and then the bank that provides leverage to the fund in trouble.”

Questions about the potential threat gained urgency following the demise earlier this month of Silicon Valley Bank, a major provider of financing to venture capital and private equity funds. Credit Suisse Group AG, which fell into difficulties a few days later, also provided various forms of credit lines to fund managers. Although neither bank’s problems were caused by those debts, the worry is they could have triggered wider contagion if the lenders hadn’t been rescued.

The decision to guarantee SVB’s depositors raised concerns that something wider has been missed around the systemic risk posed by the lender, according to a former Bank of England official, who spoke on condition of anonymity because that person wasn’t authorized to speak publicly.

Unlike banks, private equity and credit funds are protected in crises by the fact that their investors commit capital for lengthy periods of time. But the ignorance around potential problems and frailties that shadow banking poses to the financial system worries watchdogs, another former Bank of England official said.

The recent turmoil will likely lead to deeper probes into shadow lending globally, which includes credit provided by private equity firms, insurers and retirement funds, according to a different official with knowledge of the matter. That means identifying where the risk ended up after it moved off bank balance sheets following the financial crisis. Regulators also want to examine the credit risk to banks from the loans they made to buyout firms during the boom in alternative assets, the person said.

To help spot potential problems, the BOE plans to stress test nonbank lenders including private equity firms for the first time this year. Further details are expected to be announced in the coming days.

Fund managers are also concerned. A systemic credit event poses the biggest threat to global markets, and the most likely source of one is US shadow banking, according to a survey of investors published last week by Bank of America Corp.

The US government’s top financial regulators signaled in February that they would consider whether any nonbank firms merit tougher oversight as systemically important institutions.

The Financial Stability Oversight Council will put “nonbank financial intermediation” back on the table as a priority for 2023, according to a statement from the Treasury Department. The Federal Reserve, the Federal Deposit Insurance Corp. and the Financial Stability Board declined to comment for this story.

European Central Bank Vice President Luis de Guindos warned in an interview with Business Post published on the ECB website Sunday that nonbanks “took a lot of risks” during the era of low interest rates and potential vulnerabilities “can come to the surface” as monetary policy changes.

Layers of Debt

Debt has always been an important part of the business model pursued by private equity firms, but in recent years the borrowing hasn’t just been limited to loading up new acquisitions with loans to try to boost performance.

Institutions at each level of the private markets food chain — from debt and private equity funds themselves to their management, the businesses they own and even investors into their funds — can now access a wide variety of leverage from banks and other debt specialists.

An increasingly popular area is net-asset-value lending, a type of borrowing where buyout firms raise money against a bundle of assets they own. As sponsors struggle to sell businesses amid rising rates and challenging financing markets, they increasingly rely on such loans to shore up portfolio companies and keep distributing money back to their investors.

The loans are modest compared with the types of leverage in circulation before the global financial crisis, but similar types of investors provide the debt at each level, meaning a serious pull-back due to an unforeseen event could cause profound strain across the entire ecosystem, said some of the people. One concern is that private equity leverage could trigger a tightening in credit conditions if the firms were caught up in a bout of volatility that made them unable or unwilling to lend or buy assets, one of the former Bank of England officials said.

Even before the recent turmoil, some finance providers were starting to rethink their exposure to the shadow banking sector. Banks were less willing to extend fund-level leverage to direct lenders in January and there’s been a wider pullback by private lenders, some of whom have ceased making new leveraged buyout loans, Armen Panossian and Danielle Poli, managing directors at Oaktree Capital Management LP, wrote in a memo.

Competition among private lenders is starting to drop as companies face “declining revenues, shrinking margins, and high input costs,” Panossian and Poli said in the note published in January.

Hidden Risks

Banks also began trying to offload positions in leveraged funds from about September, according to one asset manager who has been approached by lenders, adding that it gave him some concern as it was the first time he had seen them try to do so.

The pullback hasn’t left funds short of financing options for now because debt funds, other banks and institutional investors have still been willing to allocate additional capital.

Regulators are still worried though that there are hidden risks in a sector that has been left to its own devices. Private credit will be an area of focus this year, one watchdog said, in part because it is predicted to double its assets under management to $2.7 trillion by 2026.

“Warning signs are developing in what is a completely unregulated segment of the financial markets with substantial amounts of hidden leverage and opaqueness,” asset manager VGI Partners Global Investments Ltd. said in a letter to investors at the end of January. “Private equity funds may prove to be a hidden risk in the system.”

--With assistance from Philip Aldrick, Lizzy Burden, Jana Randow, Katanga Johnson and Hayley Warren.

©2023 Bloomberg L.P.