Aug 31, 2022

Banks Avoid Worst of Europe Energy Crisis as Governments Step In

, Bloomberg News

(Bloomberg) -- When German utility Uniper SE on Monday requested another 4 billion euros in bailout loans, it didn’t mention some key beneficiaries of the move: its banks.

More than two dozen lenders including BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group Inc. have jointly committed 1.8 billion euros ($1.8 billion) to the company, which would be in more serious trouble if it weren’t for government intervention. Uniper has an investment grade credit rating only because the rating providers expect Berlin will continue to support it.

Uniper, whose total government support could swell to over 20 billion euros with the latest request, helps explain why the region’s banks are so far sanguine about risks to their loan books. Even as Europe’s energy crisis worsened last quarter, provisions for bad loans declined with executives signaling they expect taxpayers to pick up much of the bill, as they did in the pandemic lockdowns.

“We are convinced that there will be some government measure” if Russia were to stop exporting natural gas to Europe, Commerzbank AG Chief Financial Officer Bettina Orlopp said on a recent earnings call, explaining why she expects defaults to remain manageable. The bank didn’t forecast how much provisions would rise if there wasn’t any government help, because such a scenario just wasn’t feasible, she said.

Why Europe Is Crippled By a Wartime Energy Crisis: QuickTake

The relaxed outlook contrasts with a spike in European power and gas prices, which has exacerbated skyrocketing inflation and dramatically increased the economic burden on businesses and households. The European Union is now preparing to intervene in energy markets as it’s contemplating the prospect of Moscow turning off gas, potentially forcing parts of European industry to shut down.

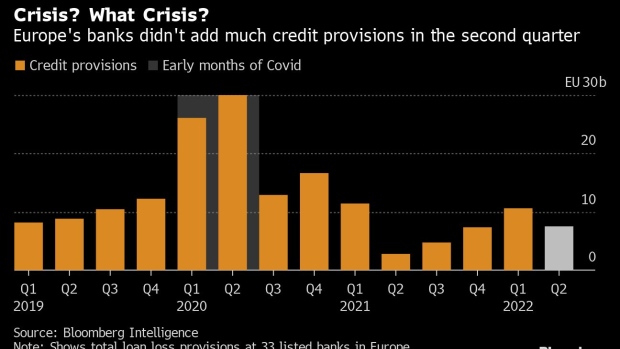

Even as lenders acknowledged the worsening outlook in the second quarter, they set aside about 30% less for doubtful loans than in the prior quarter, according to data compiled by Bloomberg Intelligence.

Uniper isn’t the only European company getting a government bailout over exploding energy prices. Its majority owner, Fortum Oyj, last week urged Nordic governments to step up help for troubled energy traders and the European Energy Exchange repeated that call. Austrian utility Wien Energie received a 2 billion-euro credit line from the government, Finance Minister Magnus Brunner told reporter Wednesday.

The massive and rapid deployment of government support during the pandemic lockdowns is a key reason why bankers are much less concerned now. Orlopp said certain governments would launch new rescue programs if push came to shove “because they have proven to be very efficient during the Corona pandemic.”

Deutsche Bank Chief Executive Officer Christian Sewing voiced a similar sentiment when saying on an earnings call that “the experience in the past” made him believe governments “would step in” in an economic emergency. Still, Deutsche Bank’s worst-case scenario doesn’t factor in any state aid, he said.

But the financial resources governments made available during the pandemic don’t just provide a historic precedent. Banks can also repurpose the massive loan loss provisions they built up in 2020 to ward off the anticipated hit from the pandemic, which ultimately remained contained.

What Bloomberg Intelligence Says:

“One of the key pillars supporting European banks’ sanguine guidance on expected credit losses -- at least in the near term -- are the provisions and management-overlay buffers built up since 2020, which have been released at different paces over the past few quarters.”

Lento Tang and Ilia Shchupko, BI bank analysts

Read the full report here.

Austria’s Erste Group Bank AG is a case in point. The lender reported a 53% increase in profit in the second quarter as a release of Covid provisions outstripped money set aside for fallout from Russia’s invasion of Ukraine. If Europe was to be cut off from Russian gas, the Austrian bank would see its non-performing loan ratio almost double to 4%, said Chief Risk Officer Alexandra Habeler-Drabek.

“The impacts would be meaningful, but in our view, manageable,” she told analysts. While the forecast didn’t factor in “material” state aid, “we do not rule out” that it would come if needed, she said.

©2022 Bloomberg L.P.