Mar 7, 2022

Banks Cautious About Cash, Funding-Stress Barometer Shows

, Bloomberg News

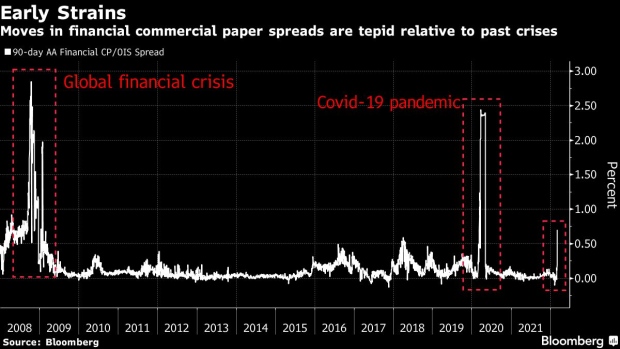

(Bloomberg) -- A key gauge of funding stress in the credit markets surged, a signal that banks are girding themselves for potential disruptions amid geopolitical turmoil.

The cost of borrowing in commercial paper for 90 days jumped by more than half a percentage point to reach 1.12% as of March 4, according to Federal Reserve data published Monday. There were 12 issues of financial commercial paper with more than 81 days until maturity totaling $137 million, the figures show.

Commercial-paper costs reached the highest since the onset of the pandemic relative to swap rates, but are tepid relative to past crises. Financial institutions have been scrambling to amass additional cash as a precaution because of rising geopolitical risks and the potential impact Russian sanctions may have on bank capital and earnings.

©2022 Bloomberg L.P.