Mar 29, 2023

Banorte to Add 800 Mexico Jobs for Investment Boom on US Border

, Bloomberg News

(Bloomberg) -- Grupo Financiero Banorte, the largest Mexican-owned bank, is adding 800 jobs as the nation becomes a destination for factories looking to relocate from other far-flung countries to be closer to the US.

The firm, which employs more than 30,000 people in Mexico, is increasing its workforce as it looks take advantage of the trend known as nearshoring, the bank’s Chairman Carlos Hank González said. The new jobs will range from marketing to customer care, with most of the hiring coming in the wholesale division to offer services to small and medium-size businesses.

“It’s an extraordinary opportunity for Mexico, and specifically for the north,” he said in an interview in New York. “We have the capacity — because we’re a local bank — to support these investments.”

Banorte is betting the nearshoring boom will prompt a wave of migration to the country’s north from southern states, which is bound to create demand for mortgages and loans for small businesses, Hank González said after meeting with investors Tuesday. The bank is the third-largest in Mexico by assets, after BBVA and Santander, according to data from the nation’s banking regulator CNBV.

The bank estimates reshoring will add $168 billion in new exports over the next five years, according to a report published earlier this month. That represents about 6.2% of non-oil exports in 2022, it said. Still, the country must improve its public infrastructure, provide incentives for investment and integrate regions that aren’t yet on the supply chain to attend foreign markets, they wrote.

Banorte shares rose less than 1% at 8:20 a.m. in Mexico City. The shares are up 2.3% this year.

Banorte joins a chorus on Wall Street from Citigroup to Barclays that has pointed to evidence of the shift. Others, like billionaire Carlos Slim’s telecommunications giant America Movil SAB, are planning to sell global bonds denominated in Mexican pesos to take advantage of the demand for the currency.

New investments are beginning to trickle in. Tesla Inc. said it would build a new plant that Mexican officials estimate will cost billions. Last month, BMW AG said it would put €800 million into its San Luis Potosi plant.

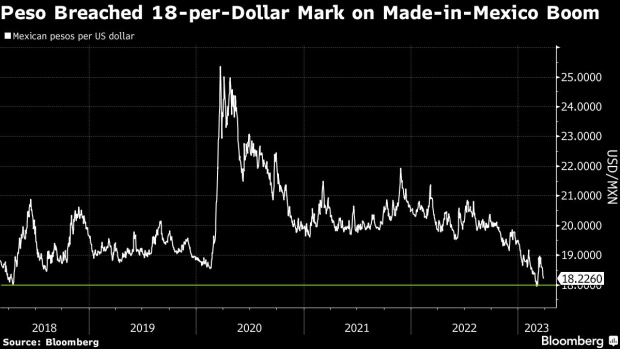

Money managers are already reaping the benefits of the trend. Optimism over money flowing into the country as corporations set up shop is in part why the Mexican peso has soared around 7% versus the greenback so far this year, more than any of its 16 major currency peers tracked by Bloomberg.

Banorte Chief Economist Alejandro Padilla said he expects the peso to hold near current levels of 18.2 per dollar, at least through the end of the year.

“It’s investors’ bet for what’s been a very positive story for Mexico,” he said.

--With assistance from Juan Pablo Spinetto and Michael O'Boyle.

(Updates with trading in sixth paragraph. An earlier version corrected name of company in first paragraph)

©2023 Bloomberg L.P.