Jun 1, 2023

Banxico Signals a Long Period of Tight Monetary Policy to Tame Inflation

, Bloomberg News

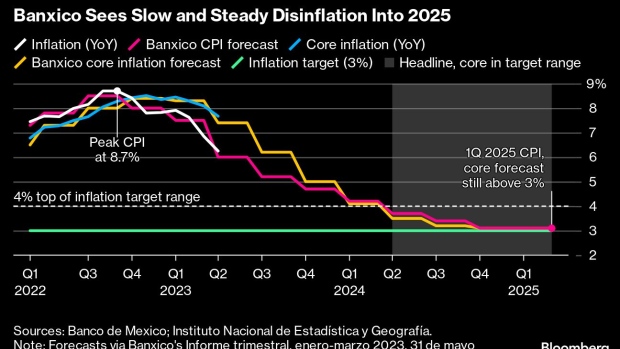

(Bloomberg) -- Mexico will need a prolonged stretch of restrictive monetary policy to get inflation back to target, according to the central bank.

The bank halted its steepest-ever series of monetary tightening last month, holding its key rate at 11.25%. But in the minutes to its May 18 meeting published Thursday, policymakers signaled that interest rate cuts won’t come any time soon amid continued uncertainty about the inflation outlook.

“In order to achieve an orderly and sustained convergence of headline inflation to the 3% target, it considers that it will be necessary to maintain the reference rate at its current level for an extended period,” the bank, known as Banxico, said in the minutes published Thursday.

Costa Rica and Uruguay have already cut interest rates, and economists expect some other major Latin American economies to follow suit this year as growth cools across the region. Chile and Colombia are forecast to follow suit over the next few months.

Read More: Banxico to Keep 11.25% Rate for at Least Next Two Meetings

One member said “an additional interest rate increase could be required if inflation does not subside”. However, if inflation slows, “an overly restrictive policy stance should be avoided, and an interest rate cut would be eventually considered,” the board member said.

The current pause doesn’t necessarily have to be followed by monetary easing, according to one member.

Another said that “high uncertainty about the inflationary process calls for a cautious approach.”

Read More: Banxico to Keep 11.25% Rate for at Least Next Two Meetings

“The board will be looking closely at inflation expectations and at core inflation, and the improvement of these variables will be the key for the cutting to start,” said Alberto Rojas, senior economist for emerging markets at Credit Suisse Group AG.

Mexican consumer price rises slowed to 6% in early May from a high of 8.8% in late August. Even so, that’s still double the 3% target.

Economists surveyed by Citi’s local unit this month forecast that the rate would be at its current level of 11.25% at the end of the year.

--With assistance from Rafael Gayol.

©2023 Bloomberg L.P.