Mar 28, 2023

Barclays Chief Says Energy Transition is ‘Defining’ Issue

, Bloomberg News

(Bloomberg) -- Barclays Plc Chief Executive Officer C.S. Venkatakrishnan said the shift to a low-carbon economy is one of today’s “defining issues.”

In his first public remarks since finishing three months of cancer treatment, Venkatakrishnan underscored the role that banks play in pushing to reduce high-emissions activities.

“It’s certainly, besides the banking crisis that comes every now and then, one of the most important issues for a CEO of a bank,” he said Tuesday at Barclays’ inaugural ESG conference for clients in New York. “We need a reduction in carbon-intensive activity and advocating for that is an important role for finance.”

Venkatakrishnan’s comments come as Republican politicians in the US attack Wall Street for its efforts on environmental, social and governance issues, which they say is part of an effort by progressives to prioritize climate change at the expense of the oil, gas and coal industries.

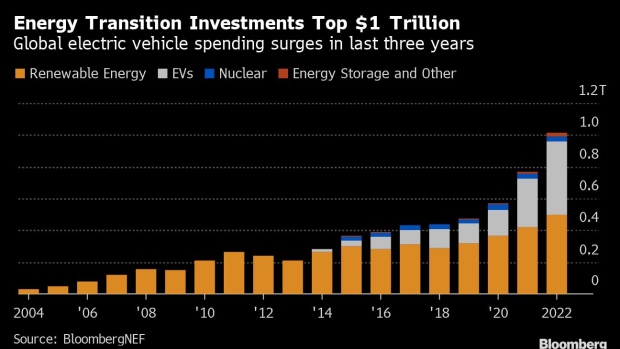

Global investments in green projects such as clean power and electric vehicles jumped by almost a third last year to $1.1 trillion, roughly equal to the amount invested in fossil-fuel production, according to researchers at BloombergNEF. Investments in renewable energy alone will need to hit $1.3 trillion a year by 2030 for the world to be meet global climate goals, according to the International Energy Agency.

The Barclays CEO said it’s important to understand and consider externalities, which are unpriced costs, and risks such as Russia’s invasion of Ukraine. “This path won’t necessarily” move in one direction, he said. “My hope is that we don’t take too many steps backwards. The challenges of the last year have just made it more apparent how difficult this is.”

Venkatakrishnan said the lender is helping the UK government with financing of a nuclear power project, as well as working with technology companies that are innovating to lower emissions.

At a conference in New York organized last week by nonprofit Ceres, billionaire investor Tom Steyer said banking is the one industry that needs to act to address climate change. US banks are the biggest financiers of oil and gas exploration globally, while European lenders have been withdrawing, he said.

Since the Paris climate agreement was announced at the end of 2015, Barclays has helped arrange $58.7 billion of green bonds and loans for clients, data compiled by Bloomberg show. In the same period, the London-based lender was involved in providing $110.9 billion of financing to fossil-fuel companies.

Barclays has been involved in about 3.5% of this year’s green bond sales worldwide, making it the eighth-biggest underwriter of the debt, according to Bloomberg data.

Three years ago, Barclays set a goal to be a “net-zero” bank by 2050. The company plans to cut the carbon footprint of its operations and also reduce financing for the highest-emitting industries such as energy, power, cement, steel and auto manufacturing. Barclays said in December that it will invest £500 million ($619 million) in climate startups by 2027, as it targets $1 trillion of green financing by the end of the decade.

Venkatakrishnan told Barclays staff earlier this month that he is in remission after getting treatment for non-Hodgkin lymphoma.

(Adds nuclear project in seventh paragraph.)

©2023 Bloomberg L.P.