Jun 8, 2023

Barclays’ Disco Bonds From 1980s Jump on Looming Repayment

, Bloomberg News

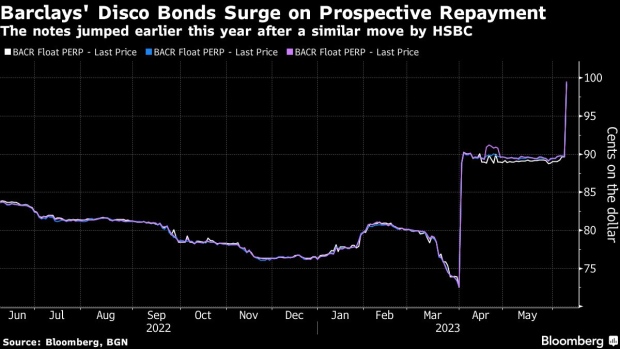

(Bloomberg) -- Some so-called disco bonds issued almost 40 years ago by Barclays Plc are nearing face value after the UK lender said it intends to redeem them.

The three discounted perpetuals, with $413.3 million still outstanding in total, rose 10 cents on the dollar after the announcement.

Several banks kept disco bonds on their books even after they stopped counting as capital because they are a cheap source of funding. Some investors have been buying up the securities in recent years, hoping to hit the jackpot if an issuer redeems them.

Disco bonds got a boost in early April when HSBC called its own series of the instruments, raising hopes that others would follow. In a note to clients at the time, CreditSights analysts led by Simon Adamson mentioned Barclays as a candidate to follow in HSBC’s footsteps.

Barclays’ disco bonds were issued from 1984 through 1986 as capital instruments. There’s now $413.3 million remaining of the initial amount of $2.4 billion. The disco bonds have produced a total return of almost 40% since the HSBC call in April, according to data compiled by Bloomberg.

Similar notes issued in the mid-1980s by DNB Bank ASA, BNP Paribas SA and Standard Chartered rose several cents on the dollar following Barclays’ announcement.

(Adds outstanding amount in first paragraph, adds other bond moves in fifth.)

©2023 Bloomberg L.P.