May 25, 2023

Barclays, Goldman Calls Profit From Fading Fed Rate-Cut Odds

, Bloomberg News

(Bloomberg) -- Fading odds of Federal Reserve interest-rate cuts this year are working out well for at least a couple of major bond dealers.

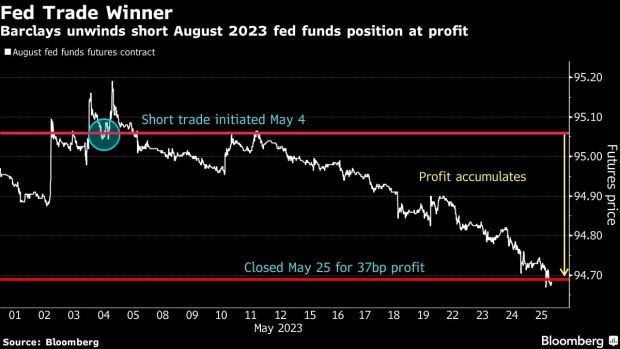

Positions designed to profit from loss of faith in rate cuts were recommended just a few weeks ago by strategists at Barclays Plc and Goldman Sachs Group Inc. On Thursday, the former cashed out for a profit, while the latter was well-in-the-money in a similar position.

Barclays advised customers to set short positions in August 2023 fed funds futures on May 4, at a point where 14 basis points of easing were priced in for July. When the same contract priced in 25 basis points of tightening on Thursday, customers that sold 10,000 contracts at the recommended level had a profit more than $15 million.

While a rate increase in June also remains in play — with around 15 basis points of tightening priced in — hike expectations broadly are at risk of setbacks from downside surprises by economic data, Barclays rates strategists Anshul Pradhan and Samuel Earl wrote.

Goldman Sachs strategists recommended paying December 2023 swap rates, equivalent to shorting the futures, on May 5. Since then, profit on the trade amounted to about 58 basis points — more than $24 million per 10,000 contracts.

Goldman Sachs Joins Barclays in Bet Against Fed Cuts This Year

The positions also face risk from lawmakers’ ongoing talks about the need to raise the federal debt limit causing volatile front-end price action. A resolution is viewed as a likely boon for risk assets, potentially clearing the way for a June rate increase that might otherwise be skipped.

©2023 Bloomberg L.P.